What’s not to like about a few days off and a possible market rally?

After a year filled with depressing news, it’s refreshing to have a bit of relief from the constant negativity.

While we should still be cautious with our investment activity, some positive sentiment is creeping into the market, which cannot be ignored.

While we should still be cautious with our investment activity, some positive sentiment is creeping into the market, which cannot be ignored.

The saying “sell in May and go away” may hold this year, but we could see a decent rally in the coming months to make a sell in May reasonably lucrative.

My long-term outlook remains unchanged, but people are getting tired of negative news.

In a week earmarked for reflection as we remind ourselves this Easter of a true resurrection, I think it would be great to see some improvement in market sentiment for a month or two.

There is no guarantee that the recent improvement will continue. Still, as an advocate of going against the trend, the increase in pessimistic forecasts from the “trying to keep up” community is a little encouraging regarding a potential upside move.

We can’t ignore that Easter gives us two short weeks, with many players using the next few days to take a well-earned break.

We can’t ignore that Easter gives us two short weeks, with many players using the next few days to take a well-earned break.

That will allow for a bit of bullying by more significant players, who can move these nervous and thin markets in any way they want.

My exposure to the markets is minimal, so whatever happens, I will not get hurt much. Moreover, my doctor has now put me on morphine, so even if it does become painful, I probably will not feel it!

Yep, it’s not like me to be positive concerning the economy, but as I have said before, there will always be a few opportunities to exploit.

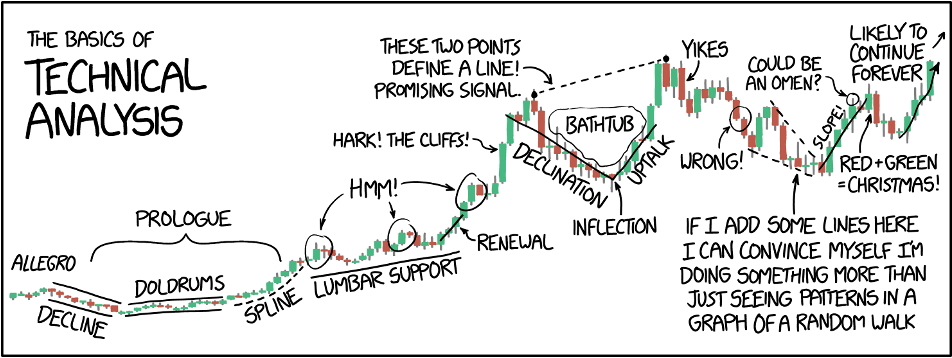

If you are looking for some decent ideas, the guys at SGT have started publishing some technical analysis charts worth looking at.

They do not issue recommendations, but I like their common-sense approach to pointing out potential chart patterns and break-out levels—none of this highly technical, reinventing-the-wheel stuff, which causes more confusion than it provides insight.

They do not issue recommendations, but I like their common-sense approach to pointing out potential chart patterns and break-out levels—none of this highly technical, reinventing-the-wheel stuff, which causes more confusion than it provides insight.

Although I am biased, I do like what’s happening at SGT, where people are working hard to introduce products that provide a valuable opportunity to serious investors.

Sometimes, I look around at products promoted elsewhere, and while I love the innovation, I need help seeing the benefit for me as an investor and trader.

With SGT, the benefits and opportunities are clear for all to see.

Like many of you, I am taking a break over Easter (going to explore the Basque region of Spain and France), so I am writing this on the morning that Finland joined NATO, just before Donald Trump became the first President in history to get arrested.

Considering Finland was part of Russia until 100 years ago, I hope they know what they are doing. After all, Mr Putin does like to mention history when he makes a move.

But Finland is not the story of the day.

But Finland is not the story of the day.

The story is about the continued witch hunt against Trump.

I appreciate that opinions about Trump vary. However, it is evident that the Biden administration has not only been bad for freedom-loving people everywhere and a disaster for global security but has also played a significant role in destroying economic stability across the Western world.

Going forward, we need some stability and growth, but this Biden administration is not providing it.

We need to hear about solutions and how our leaders will combat inflation, which is essential.

Another vindictive attack on an ex-President will not make me or you better off.

Nor will we be better off if the current administration continues employing Marxist policies and practices.

I am sure the ongoing circus will keep us all entertained, but it is a sideshow we can all do without.

I am sure the ongoing circus will keep us all entertained, but it is a sideshow we can all do without.

However, if it keeps Hunter’s laptop off the front page, you can’t blame Joe for giving it a go.

But you will know more than me by the time you read this.

Until next time

Happy Easter.

Connect with JP Fund Services

Follow us for the latest news & insights

The post Time for a Bull Run appeared first on JP Fund Services.

The post Time for a Bull Run first appeared on trademakers.