According to recent surveys, readers of “The Old Man’s Views” are happier and better looking than those who ignore them.

This week, the good news is that the Carnival in Rio took place for the first time since Covid, and few events in the world are happier and more cheerful.

This week, the good news is that the Carnival in Rio took place for the first time since Covid, and few events in the world are happier and more cheerful.

Due to closures for Washington’s birthday, we also had a short week in the markets.

I know they now prefer to call it President’s Day, but the idea of celebrating Nixon and Biden doesn’t sit with me too well.

Biden used the day to heroically visit Ukraine, who were kind enough to sound off the warning sirens during his epic speech in front of the world’s media. What a circus!

It’s one year since Russia invaded Ukraine, and there is hardly anything to celebrate. I am still scratching my head as to why no peace negotiations are occurring. Surely, it must be possible to find a few grown-ups who can sit at a table and start thrashing out some compromise with Putin. I am not talking about appeasing Putin, but there are two sides to every argument, and I would rather jaw-jaw than war-war.

The West might not get what it wants, and Zelensky will not get what he wants, but this war is dangerous and costly, and pumping large amounts of ammunition and money into Ukraine to keep the fight going is not sustainable.

The West might not get what it wants, and Zelensky will not get what he wants, but this war is dangerous and costly, and pumping large amounts of ammunition and money into Ukraine to keep the fight going is not sustainable.

Moreover, we know that sanctions have inflicted as much damage on the West as they have on Russia, so let’s stop waving big sticks and start discussing solutions.

The war has weened Europe off its dependence on Russian energy, which is an excellent long-term thing; but as a consumer, I want to see lower energy prices better reflected in my monthly bills and at the pump. Having stopped myself out on a small, long position in Nat Gas, I would like to get something back from the utility company.

As a lesson, it pains me no end to get stopped out at what might be close to the low on Nat Gas, and it was extremely tempting to move the stop. But as I preach against moving stops, I took the hit and will look for new pastures.

As far as pastures are concerned, grains and beans continue to hold well, and whilst there have yet to be any fireworks in these markets, there is still time for potential problems, especially in the Midwest. Hence, an opportunity for increased prices remains with us.

Since last week’s report, we saw another stab on the upside in BTC and Altcoins, with BTC having a quick look at the 25,000 level, which put a smile on a few faces. Will these levels hold? Who knows?

I am yet to see massive amounts of enthusiasm on social media encouraging people to run back into crypto, so it’s a bit early to get carried away. The recent strength could result from those with established positions simply adjusting their books and a few short-term players having a punt.

I am yet to see massive amounts of enthusiasm on social media encouraging people to run back into crypto, so it’s a bit early to get carried away. The recent strength could result from those with established positions simply adjusting their books and a few short-term players having a punt.

I would like to see BTC improve and test the 28,000 and then 32,000 levels, but whether that is possible from here is yet to be confirmed, so I will not be adding to what I already have at current levels.

I have noticed recently that some of the more serious Altcoins continue to develop their activities and utility, which does bode well for the future, providing politicians don’t drink too much firewater and go on the warpath.

Sadly, so much of where the markets go depends on the actions of crazy politicians, and forecasting “crazy” is a fool’s errand.

Like everyone else, I am seeing lots of crazy and unfathomable decisions being made by global leaders, especially western leaders, so long-term investment strategies are really difficult to formulate.

Like everyone else, I am seeing lots of crazy and unfathomable decisions being made by global leaders, especially western leaders, so long-term investment strategies are really difficult to formulate.

We can all guess, but does any of us really know?

I will finish on something I find very strange.

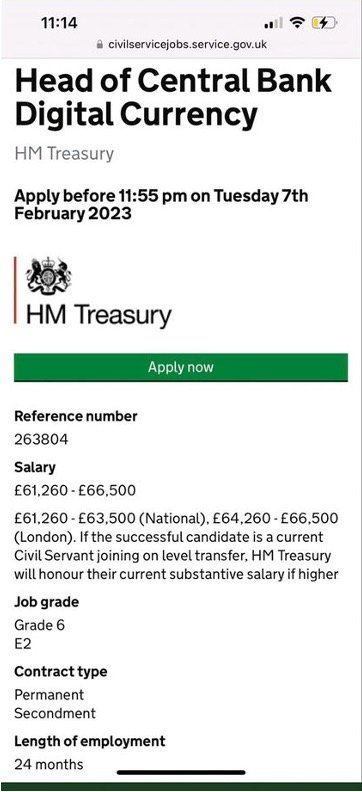

The UK Treasury has been advertising for a director of its Central Bank Digital Currencies department. (the deadline has passed, so there is no need to apply).

We all have opinions on CBDC and what effect it will have on our daily lives. I was not particularly shocked that the treasury created such a post.

However, it came with an advertised salary of just £61-64,000. I no longer live in London, but my cousin does, he’s a plumber and earns a lot more than that, so who are they trying to attract?

It makes you think, eh?

Until next week.

The Old Man’s Views

According to recent surveys…

appeared first on JP Fund Services.

The post The Old Man’s Views According to recent surveys… first appeared on trademakers.