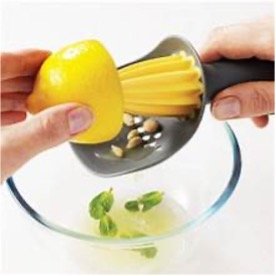

The danger of trying to squeeze the last juice out of the lemon, is that it often results in lots of pips.

In our buy-side orientated business, where most portfolios are full of products that have been bought, most managers want to see higher prices towards the end of the year, so they can bank some profits, and declare a better year-on-year performance, which ultimately means higher bonuses.

In our buy-side orientated business, where most portfolios are full of products that have been bought, most managers want to see higher prices towards the end of the year, so they can bank some profits, and declare a better year-on-year performance, which ultimately means higher bonuses.

Make no mistake, as our industry is the last Bastion of Capitalism, everyone is in it for the money, and there is nothing wrong with that!

Knowing that these “pump-my-bonus” rallies occur almost every year allows us as speculators to join in the fun and make ourselves a few bucks as well, just in time for Christmas.

We can discuss the technical picture or delve into changes in short-term fundamentals, but when it comes to December, it’s less to do with science and more to do with fund managers wanting to make their books look as good as possible for year-end reporting.

A month ago, we discussed taking advantage of these opportunities and increased our long positions in numerous products. Last week, we banked our profits.

Looking at current levels, we might well have hit the market at the right time, or it is possible that we could see one more rally in the run-up to Christmas. Either way, from a speculator’s point of view, I am more than happy to have got in, banked some money, and taken a lot of risk off of the table.

There will be some traders out there who have held on to their long positions trying to maximize the return from the annual Santa Claus rally, – trying to squeeze a little more. But, who really wants the headache during the week running up to Christmas. A time when most people are more concerned about buying presents and having lunch with their friends.

Furthermore, if the markets do slip lower over the coming week, will they be kicking themselves because they “could have or should have”?

As we discussed a few weeks back, December always provides a few decent opportunities to speculators, and we should treat them as such, just short-term punts.

No two investors approach their speculating activity in the exact same way, as we all have our own unique experiences and circumstances, which affect our risk and greed parameters.

Sure, we can look at the same chart of the same product, pick the same entry point, and if our strategies are similar, place a stop-loss order at the same level.

But getting into a speculative position is the easy part.

Buying into a risky asset doesn’t guarantee you will make money. Your profit is only realized when you exit a position, and it’s the choosing of when you exit, that reveals the difference between you and other traders.

There are loads of alternative strategies, including those whose investment mentally is more akin to “shit or bust”.

There are loads of alternative strategies, including those whose investment mentally is more akin to “shit or bust”.

But as I do not visit Casinos, I am not an expert on gambling.

I appreciate that the old adage “nobody has ever gone broke taking a profit” is not 100% true, However, when looking for seasonal rallies, swing trading or day trading, taking profits when they appear and reducing risk, especially ahead of a holiday period, is always a prudent action to consider.

Overall, I am still concerned about the long-term outlook for the economy, so when entering new long positions, managing my risk is much more important than the amount of profit my exposure generates.

As we near the end of the year, many will be issuing entertaining projections and predictions for 2024, and I look forward to reading through a few of them. However, as I have been mentioning for the past few years, we are in uncharted waters, vis-a-vis the massive changes in Geo-politics, as well as the massive unprecedented increases in regulations, which are proving to be a heavy burden on everyone’s life. No one knows how this picture will play out in 2024 or the years after.

Some accuse me of being cynical. But I have lived through a time when Western Central Banks sold their Gold at $400 because it was “good for the economy”. More recently, everyone was telling me the great thing about crypto is that “they were beyond the control and influence of Central Banks and governments”, and now everyone is saying “we need government rules and regulations” if we want crypto to be a success in the future.

I have plenty of reasons to be cynical, but I do not let that get in the way of my speculating, because at the end of the day – whatever shit is thrown our way – our job is making money, pure and simple!

People will ask me what I am looking forward to next year?

For entertainment purposes, there is one thing.

I want to be a fly-on-the-wall at the next meeting of the BRICS, when the new President of Argentina, sits down with Xi and Putin and tells them “his economic plans” for the future.

I want to be a fly-on-the-wall at the next meeting of the BRICS, when the new President of Argentina, sits down with Xi and Putin and tells them “his economic plans” for the future.

There will be some outrageous forecasts issued very soon, and some from some very serious people. But nothing is going to be more entertaining than watching President Javier Milei trying to impose his economic views at the next BRIC Summit.

Now that is something, other than celebrating 50 years in this crazy business, I am really looking forward to in 2024!

The post The Danger of Squeezing The Lemon first appeared on JP Fund Services.

The post The Danger of Squeezing The Lemon appeared first on JP Fund Services.

The post The Danger of Squeezing The Lemon first appeared on trademakers.