When FTX went down I was heavily criticized for not being too sympathetic towards those who lost money. Caveat Emptor, Let the buyer beware!

Now that Sam Bankman-Fried is going down, I have no sympathy for him either. Moreover, everyone he donated money to, including his parents, Joe Biden, and every politician, irrespective of party, should be forced to return what they received from his ill-gotten gains, and chased by the receivers.

Now that Sam Bankman-Fried is going down, I have no sympathy for him either. Moreover, everyone he donated money to, including his parents, Joe Biden, and every politician, irrespective of party, should be forced to return what they received from his ill-gotten gains, and chased by the receivers.

This is no time to go soft on corruption.

To those who lost money with FTX or Alameda, what you have had is a very expensive lesson in regards to knowing who you are dealing with and understanding counter-party risk. Moreover, if it looks too good to be true, it probably is.

The crypto industry put SBF on a pedestal, for very little reason other than he was an early player in crypto and as a result made a lot of money from it.

What we in fact had was a kid, 5 years out of University, who, although extremely bright, didn’t know his ass from his elbow, when it comes to investing or the intricacies of the investment industry. The fact that he didn’t have a clue about risk management is testimony to his lack of knowledge. As well as his lack of respect for other people’s money.

The fact that he was so young and inexperienced, would incline me to believe, as a good Jewish boy, his parents who are law Professors, and his brother who has some experience on Wall St. must be involved somewhere, at least in an advisory capacity.

The fact that he was so young and inexperienced, would incline me to believe, as a good Jewish boy, his parents who are law Professors, and his brother who has some experience on Wall St. must be involved somewhere, at least in an advisory capacity.

We also have to consider the amount of political clout this kid was able to employ. It is absolutely mind shattering that this kid’s political donations only came second to the likes of Michael Bloomberg and George Soros, and the Democrat Party didn’t question what was going on.

Moreover, as these donations were widely reported, surely those who had invested in FTX must have questioned where their investment capital was being used. But they didn’t.

I have certain reservations about many people running large crypto exchanges, some concern in regards to the political agenda of some exchanges, and even more concern about how the industry is developing under increasing government rules and guidelines. But then again, I am naturally cynical towards any business or industry with overly strong connections to politicians.

I have certain reservations about many people running large crypto exchanges, some concern in regards to the political agenda of some exchanges, and even more concern about how the industry is developing under increasing government rules and guidelines. But then again, I am naturally cynical towards any business or industry with overly strong connections to politicians.

I would never have invested with SBF, because everything surrounding him didn’t make sense. It just stank of not being Kosher, and therefore the sustainability of the growth was highly questionable.

I know lots of people in the crypto industry, including Chairmen and CEO’s, wear blinkers when it comes to how the industry has changed and the direction it is now going, and they will find a lot of excuses to promote the industry based on what it was 5-years ago, instead of what it is today. And, what it might become tomorrow.  But if you take away the personal wealth, real or imagined, of some of these people, I might listen to their opinions on how they are developing their products, but there is very few to whom I would trust my hard-earned capital.

But if you take away the personal wealth, real or imagined, of some of these people, I might listen to their opinions on how they are developing their products, but there is very few to whom I would trust my hard-earned capital.

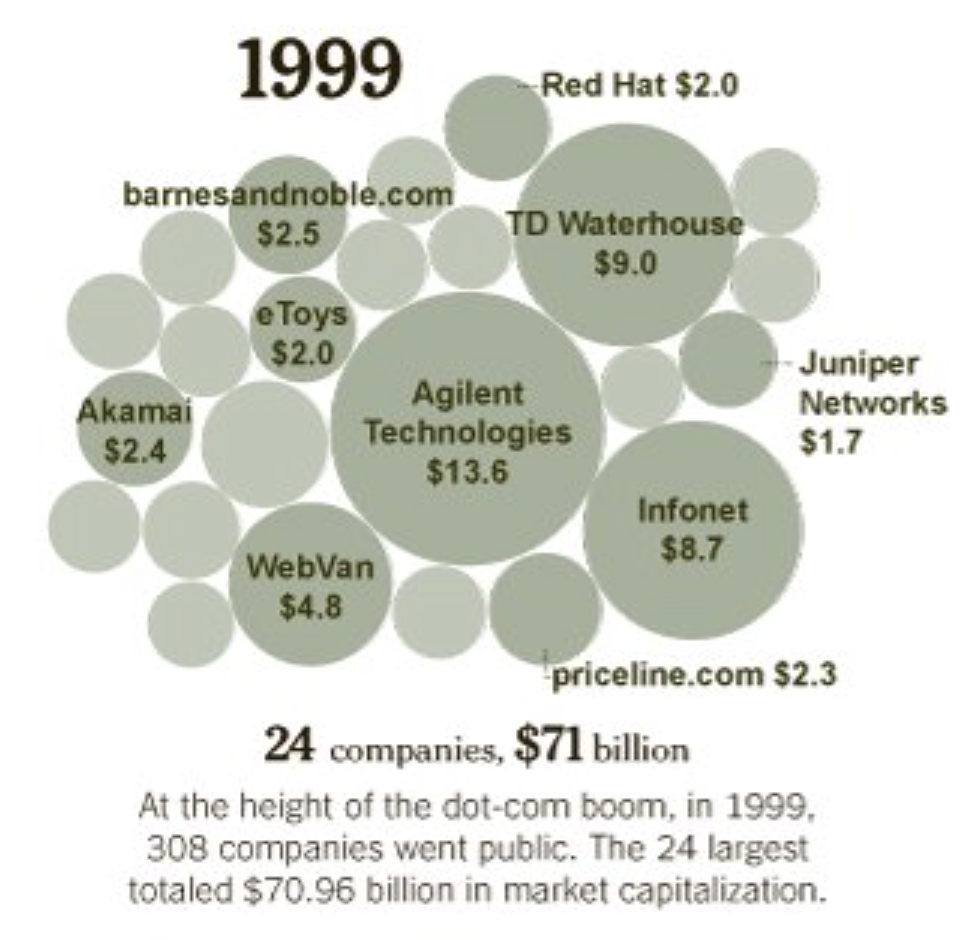

Perhaps it’s because I am old enough to have seen numerous ponzi schemes in the past. Perhaps it’s because I lived through the dot.com bubble and saw a lot of investors lose large chunks of money on the next big thing! Yes, internet was the next big thing, but most companies who raised vast amounts of investment capital are no longer with us. And if we look at the comparison between internet and crypto, let’s not forget that the internet never had the type of political opposition that crypto is constantly suffering.

Perhaps it’s because I am old enough to have seen numerous ponzi schemes in the past. Perhaps it’s because I lived through the dot.com bubble and saw a lot of investors lose large chunks of money on the next big thing! Yes, internet was the next big thing, but most companies who raised vast amounts of investment capital are no longer with us. And if we look at the comparison between internet and crypto, let’s not forget that the internet never had the type of political opposition that crypto is constantly suffering.

As someone who is not very technically minded, and a bit of a dinosaur in the digital world, I do believe that the block-chain offers many advantages to a multitude of industries and government entities. And as a Libertarian, I have an incredible amount of respect for financial freedom Bitcoin has the potential to offer humanity, especially in this increasingly Authoritarian World.

But some of the other Altcoins and tokens, even the likes of USDT and USDC, I am not convinced about them or their potential for longevity.

Just what will be the future of staple-coins when CBDC are introduced?

I have more questions than answers when it comes to the current crypto industry. And when it comes to employing my own capital, I want more than someone’s opinion before I open my wallet!

I am not against the business Indeed I want it to succeed and flourish and furthermore, I truly believe that there is much being developed in the industry which, over the long term, will prove quite valuable, both financially and to society.

That said, from an investment point of view, I don’t expect most of today’s coins to last the passage of time. Just like most major companies at the time of the dot.com bubble are no longer the major internet players, and that’s if they even exist today. Ignoring the lessons from the past is rarely profitable.

Sure, you can, in your heightened state of greed, ignore the lessons of the past, but that is where people like SBF are waiting in the wings.

Sure, you can, in your heightened state of greed, ignore the lessons of the past, but that is where people like SBF are waiting in the wings.

People lost their money with FTX because their greed and ambition to make easy money, outweighed the decision to carryout proper investigations and compliance on the people where they placed their money.

It was a gamble. If it came off, great! But it proved to be a gamble that didn’t come off, so please, save your tears!

Yes, you got screwed, but it was only money.

A good-looking young boy like Sam Bankman Fried, he will be getting screwed for the next 10-years, and I am not talking about out of a few bucks.

Take some solace from that.

The post SBF and all your dough! first appeared on JP Fund Services.

The post SBF and all your dough! appeared first on JP Fund Services.

The post SBF and all your dough! first appeared on trademakers.