After all the times I’ve preached about staying unemotional in trades – cutting losses, avoiding the trap of “marrying” a position – I did exactly what I always warn against.

I held on too long, didn’t follow my plan, and ended up with losses worse than I had expected.

There’s no excuse. I slipped up, and it hurt. That’s trading. The key now isn’t to dwell on it or pretend it didn’t happen – it’s to learn from it, reset, and get back to solid footing.

And with that, let’s talk about the current market chaos.

Trump’s latest round of tariffs has everyone spinning. Normally, you’d expect protectionist policies to strengthen the U.S. dollar. Investors usually run to it when things get shaky. But right now, the opposite is happening. The dollar’s losing ground, stocks are wobbling but holding, and agricultural commodities – especially soybeans – are showing surprising resilience despite China’s threats.

So, what’s behind the disconnect?

A big part of it comes down to how the market is now interpreting tariffs. They’re no longer seen as a show of strength – they’re viewed as a drag on growth. That shift in perception has put pressure on the Federal Reserve. If the economic outlook dims, rate cuts become more likely, and nothing undercuts the dollar faster than a dovish Fed.

China, meanwhile, isn’t sitting still. They’ve quietly been reducing their holdings of U.S. Treasuries and ramping up efforts to build yuan-based trade relationships. That pumps more dollars into the system, pushing the greenback down further. Combine that with growing budget deficits from tax cuts, farm subsidies, and tariff fallout, and the fundamentals that usually support the dollar are suddenly looking shaky.

Then there’s the commodity side of the story. On paper, the soybean situation looks bleak. China is America’s biggest customer. If they stop buying, prices should fall off a cliff, right? But markets rarely follow simple logic. The reality is more nuanced.

Yes, China is posturing, but they’re not in a position to cut U.S. soybeans out forever. Their massive pork industry depends on soybean meal, and while Brazil has stepped up as a major supplier, it still doesn’t have infinite capacity. Global demand is rising, and China learned during the last trade war that turning its back on American agriculture carries real costs. When things eventually calm down – as they usually do – history suggests they’ll come back to the U.S. quietly, just like they did before.

Meanwhile, Washington has made it clear that it’s willing to support farmers when trade tensions hit. The $28 billion bailout during the last tariff battle is proof of that. If prices fall again, there’ll likely be more of the same – plus new strategies to create demand elsewhere, like boosting biofuel production or finding alternative export markets.

Brazilian supply chains are not perfect, and any weather problems could cause major damage. In Argentina farmers have been slow to sell their soybeans as the peso devalues and are still recovering from drought. The global soybean supply chain is on a knife’s edge. One shock – logistical, political, or environmental – could send prices spiking overnight.

Traders have rushed to price in a worst-case scenario from the tariffs, but that often creates opportunity. When the market overreacts, any hint of a compromise or backchannel deal – maybe even a small purchase from China – could trigger a sharp reversal. This isn’t just a simple supply-demand equation anymore. It’s politics, psychology, and supply chain fragility all wrapped together.

Looking elsewhere, volatility is a given across all capital markets.

Tech stocks could suffer thanks to their exposure to China, while sectors like defence or domestic-focused retail might hold up better. If the Fed does cut rates, Treasuries could rally, but the dollar would probably stay under pressure. Commodities will likely stay messy – gold should continue to thrive in these kinds of environments, and oil is the wild card, especially with Middle East tensions simmering and political pressure to keep gas prices down.

The bigger takeaway? Trump’s tariffs aren’t just about trade. They’ve become a full-blown market disruptor. The dollar isn’t reacting the way it “should.” Commodities are doing their own thing. And the Fed is stuck in reactive mode, trying to clean up the consequences.

So, here’s how I’m approaching it: Stay flexible. Don’t rely on old rules. And keep an eye on the chaos, because in markets like this, logic doesn’t always win – but preparation does.

As for me, I’m back on track with my risk management, watching the markets closely – and maybe shopping for a few cheap soybean contracts while the rest of the market is still in panic-mode.

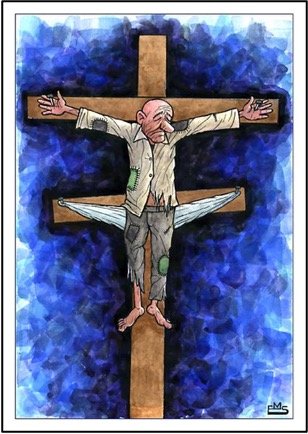

The post Of all the weeks to get crucified by the markets, Easter might be the most ironic first appeared on JP Fund Services.

The post Of all the weeks to get crucified by the markets, Easter might be the most ironic appeared first on JP Fund Services.

The post Of all the weeks to get crucified by the markets, Easter might be the most ironic first appeared on trademakers.