Please note the political opinions expressed below are those of the author himself, and do not necessarily reflect the opinions of JP Fund Services AS.

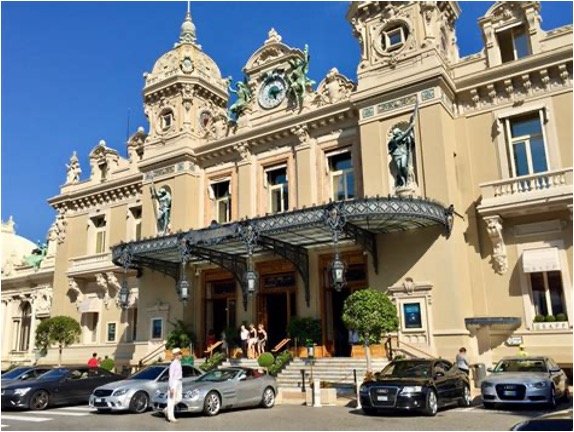

Markets this week felt a little like my wonderful weekend in Monte Carlo – dazzling on the surface, but plenty of apprehension at each turn.

Traders and tourists alike were drawn to the spectacle: bright lights, big moves, and sudden turns of fortune. Just as the roulette wheels spun on the Riviera, global markets swung between fear and relief – equities regained their stride, the dollar held firm, commodities found selective buyers, and bitcoin kept everyone guessing.

Equities – A Rally Worth Betting On

After a choppy prior week, U.S. equities staged a sharp rebound. The S&P 500 found fresh momentum, the Nasdaq posted its strongest gains in months, and the same AI-linked titans – Nvidia, Apple, Microsoft – did most of the heavy lifting. Investors rotated back into technology after a brief flirtation with defensives, encouraged by stabilising bond yields and a sense that the earnings season hadn’t been as bad as feared.

In Monte Carlo terms, it was the high rollers returning to their favourite tables: selective, confident, and a little impatient. The mood was risk-on but still wary – traders were buying strength, not chasing dreams. Europe followed with modest enthusiasm, aided by a slightly softer euro and signs of resilience in manufacturing data.

Foreign Exchange – The Dollar Holds Its Seat at the Table

Across the major currency pairs, the U.S. dollar held its seat like the calmest player in the room. The Dollar Index stayed sturdy, reflecting steady demand for greenbacks even as equities rallied. The euro hovered near the mid-1.15s, supported by mildly better data but capped by the gap between European and U.S. yields.

The yen, meanwhile, drifted lower, pressured by rising global yields and speculation that the Bank of Japan might delay tightening moves once again. Traders kept one eye on Treasury moves and another on geopolitical risk, with most desks reluctant to make big FX bets ahead of further guidance from the Federal Reserve. In short: the dollar is still the table’s house chip – the one you can’t ignore, even when you’re playing elsewhere.

Commodities – Gold’s Glow and Oil’s Balancing Act

Gold shone brighter this week, its price climbing as whispers of future U.S. rate cuts grew louder. Softer data and cautious Fed commentary sent investors looking for safe havens. It was a classic Monte Carlo mood swing: the same people celebrating gains in risk assets were quietly pocketing insurance in the background.

Oil’s path was less dramatic but no less telling. Crude prices hovered in a tight range, caught between hopes of steadier demand and ongoing questions about supply management from OPEC+. Political headlines- particularly around U.S. budget talks and global trade flows- kept energy traders guessing. For now, oil seems content to sit at the middle of the table, waiting for a clearer signal to bet big.

Bitcoin – The Wild Card

If the rest of the market week was a casino floor of calculated moves, bitcoin was the high-stakes poker table in the back. The world’s most-watched cryptocurrency remained volatile, holding well above the psychological levels traders now consider “safe,” but swinging with every new headline.

Institutional flows into crypto ETFs and fund products suggested growing acceptance, while retail traders stayed active on every dip. Bitcoin, as ever, defied neat categorization: part risk asset, part hedge, part cultural phenomenon. It moved in sympathy with tech stocks at times, and at others like its own universe – much as Monte Carlo’s private rooms hum quietly apart from the main floor.

Politics and Policy – When the Dealers Change the Rules

The biggest wild card wasn’t monetary policy at all, but politics. The ongoing fiscal drama in Washington – budget showdowns and shutdown threats – dominated sentiment early in the week. Each hint of compromise buoyed stocks, each flare of gridlock sent traders scurrying for safety.

Across the Atlantic, policymakers kept a steady hand. Norge’s Bank’s neutral tone, the European Central Bank’s cautious remarks, and local rate commentary from Latin America all painted a picture of global policy drifting slowly toward easing – but not yet ready to declare victory over inflation. For investors, it meant more waiting, more hedging, and less conviction.

What Comes Next – From Monte Carlo to Main Street

Looking ahead, the next round of inflation data and central-bank remarks will guide positioning. Traders want confirmation that the rate-cut narrative has legs – and that growth won’t roll over too fast. Earnings updates and U.S. political developments will likely remain the key volatility triggers.

In market terms, this week felt like the moment between spins – chips stacked, eyes on the wheel, no one quite sure whether to double down or cash out. Investors are hopeful, but wary; opportunistic, but aware of how easily momentum can turn.

If there’s a human story here – the same one I sensed while walking past the Monte Carlo casino at midnight – it’s about confidence and caution coexisting. The lights are bright, the stakes are high, and everyone believes they’re one good spin away from clarity. Yet underneath the glamour runs a steady awareness: risk never sleeps, and neither do the markets.

Finally.

No, I did not lose my shirt in Monte Carlo. However, as a tea-totaller, I did miss out on some superb Champagne, supplied by our wonderful host, the producer of “Les Cinq Filles”.

The post Markets, Monte Carlo, and the Week That Was first appeared on JP Fund Services.

The post Markets, Monte Carlo, and the Week That Was appeared first on JP Fund Services.

The post Markets, Monte Carlo, and the Week That Was first appeared on trademakers.