As much as we want to see Central Banks reduce interest rates until they are back below 2%, it’s a massive ask in the current economic environment.

Our natural optimism and love of history repeating itself naturally leads us to expect a return to the good ole’ days of low interest rates and low inflation, and an expectation that our central bankers and politicians will pull a rabbit out of the bag.

Sadly, such magic tricks are known to most of us, and we can see through most of the promises that those in authority toss around like cheap confetti.

Sadly, such magic tricks are known to most of us, and we can see through most of the promises that those in authority toss around like cheap confetti.

Let’s be very real here and ignore the major optimistic talking point we hear on the financial networks during times of stock market firmness.

Energy prices are on the rise, and as we are producing 500,000 barrels of crude a day less then we need, the effect of higher energy prices on the cost of living will be with us for some time.

We also have massive unsustainable government debt which although out governments keep kicking this problem down the road, the average, middle-class, taxpayer is hardly going to be any better off over the coming months or years, because the burden of paying for social welfare and other exorbitant government spending is not going to go away anytime soon, and it’s the middle class who is forced to carry this burden.

Those of us in the world of speculation and finance are in a very privileged position where we can assume a certain amount of risk, in return for enhancing our annual income. But when we look at the big picture, we are very much in the minority. Indeed, most people who managed to see their incomes rise during last year’s levels of higher inflation, where actually government employees and those supported by powerful trade unions, which tend to be in less productive or unproductive jobs.

Admittedly, this varies according to the country in which we live, but as the State becomes more influential and allows more people to enjoy the fruits of the taxpayer working in the private sector, no matter how much growth we are told is occurring, the shrinking middle-class is seeing no benefit at all. If the middle class is not seeing benefit, then we are not better off, no matter what statistic our governments and bankers want to put in front of us.

Admittedly, this varies according to the country in which we live, but as the State becomes more influential and allows more people to enjoy the fruits of the taxpayer working in the private sector, no matter how much growth we are told is occurring, the shrinking middle-class is seeing no benefit at all. If the middle class is not seeing benefit, then we are not better off, no matter what statistic our governments and bankers want to put in front of us.

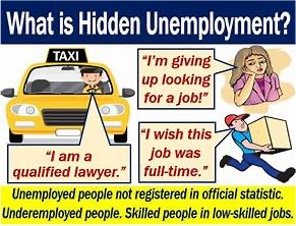

For example, much noise is made about employment and pay-role figures, but this is somewhat of a red-herring.

We might have a low unemployment figure, but if the jobs being created are in the public sector, or created by crony capitalists who suckle from the taxpayer breast, then our debt burden is not getting any better.

We might have a low unemployment figure, but if the jobs being created are in the public sector, or created by crony capitalists who suckle from the taxpayer breast, then our debt burden is not getting any better.

Moreover, if the jobs created are low paid, as many of them are, taxation from such “employed” people is not going to make a dent in our unsustainable growing debt. And the servicing of this debt is inflationary because the government has to continue to raise taxes, adding to the cost of whatever we spend our money on!

In a year such as this one, when so many elections are taking place, it is highly likely that some adjustments to interest rates will be made, because cuts are good optics for those seeking re-election, but whether our “real” current economic situation warrants lower interest rates is very difficult to assess, especially with so many geopolitical changes taking place.

We can agree with the talking-heads on TV and listen with high expectation to those who paint a rosy future and justify interest rates and inflation coming lower. But what they say and what we see in our own neighbourhoods are not exactly the same thing.

For those on the other side of the Atlantic, much trust is being put into the ability of Donald Trump turning the American economy around, which is quite possible if his focus remains on what’s good for the USA. But this side of the pond, the situation is far more precarious.

For those on the other side of the Atlantic, much trust is being put into the ability of Donald Trump turning the American economy around, which is quite possible if his focus remains on what’s good for the USA. But this side of the pond, the situation is far more precarious.

This is also a year for elections in the UK and the EU, yet we can expect nothing to change for the better. In the UK alternative is worse than what we have today, and in the EU, there can be no change whatsoever, because the EU machine is more powerful than any of its parts, including the extremely political ECB.

Immaterial of what western central banks do, and they will do something, it is very difficult to see a path to growth if we focus on interest rates and do nothing about the underlying western problems: Overzealous government spending, zero growth and increasing debt, which is leading to more devaluation of our currencies.

Immaterial of what western central banks do, and they will do something, it is very difficult to see a path to growth if we focus on interest rates and do nothing about the underlying western problems: Overzealous government spending, zero growth and increasing debt, which is leading to more devaluation of our currencies.

And sure, much can be said about the attacks on the US Dollar as the Worlds reserve currency, and there is a lot of truth in this discussion. But where does that put the Euro, which has never been a reserve currency, and by the looks of the global direction of travel, never will be.

The post Let Them Eat Cake! first appeared on JP Fund Services.

The post Let Them Eat Cake! appeared first on JP Fund Services.

The post Let Them Eat Cake! first appeared on trademakers.