It seems to me that the world is becoming increasingly tumultuous with each passing day.

As much as I wanted to, I just couldn’t bring myself to spend another week discussing Trump and Fani, or indeed, Trump’s 354-million dollars stolen by a crazy judge.

So this week, I’ve found it particularly challenging to decide what to else to discuss, given the sheer volume of nonsensical events unfolding around us.

For investors and speculators, however, these chaotic times have presented numerous opportunities for exploitation. Undoubtedly, some of the funds on trademakers have capitalized on short-term anomalies in prices and valuations, yielding impressive returns, but I have spent much of my time sitting on my hands and just watching.

Nevertheless, if I were to make a prediction for this week, it would be a significant downturn in equity markets, possibly to the tune of a 10% decline or even more in the weeks ahead. The surge we’ve witnessed lately has primarily been driven by a handful of AI-related shares, masking underlying real-world issues that are now demanding attention.

Nevertheless, if I were to make a prediction for this week, it would be a significant downturn in equity markets, possibly to the tune of a 10% decline or even more in the weeks ahead. The surge we’ve witnessed lately has primarily been driven by a handful of AI-related shares, masking underlying real-world issues that are now demanding attention.

While there’s been a wave of bullish sentiment and enthusiastic investment in AI, the broader economic landscape simply doesn’t support a continued bull run. Hence, it might be wise to consider purchasing June or September Puts on the S&P 500. Timing such a move won’t be straightforward, but when the market correction does occur, I anticipate minimal support until we approach the 4400 level. Even then, any buying activity is likely to stem from shorts cashing in their profits.

On another note, I hold a strong belief in the strengthening of the dollar against the Euro in the months ahead. However, this may not necessarily be the most advantageous currency pair to trade.

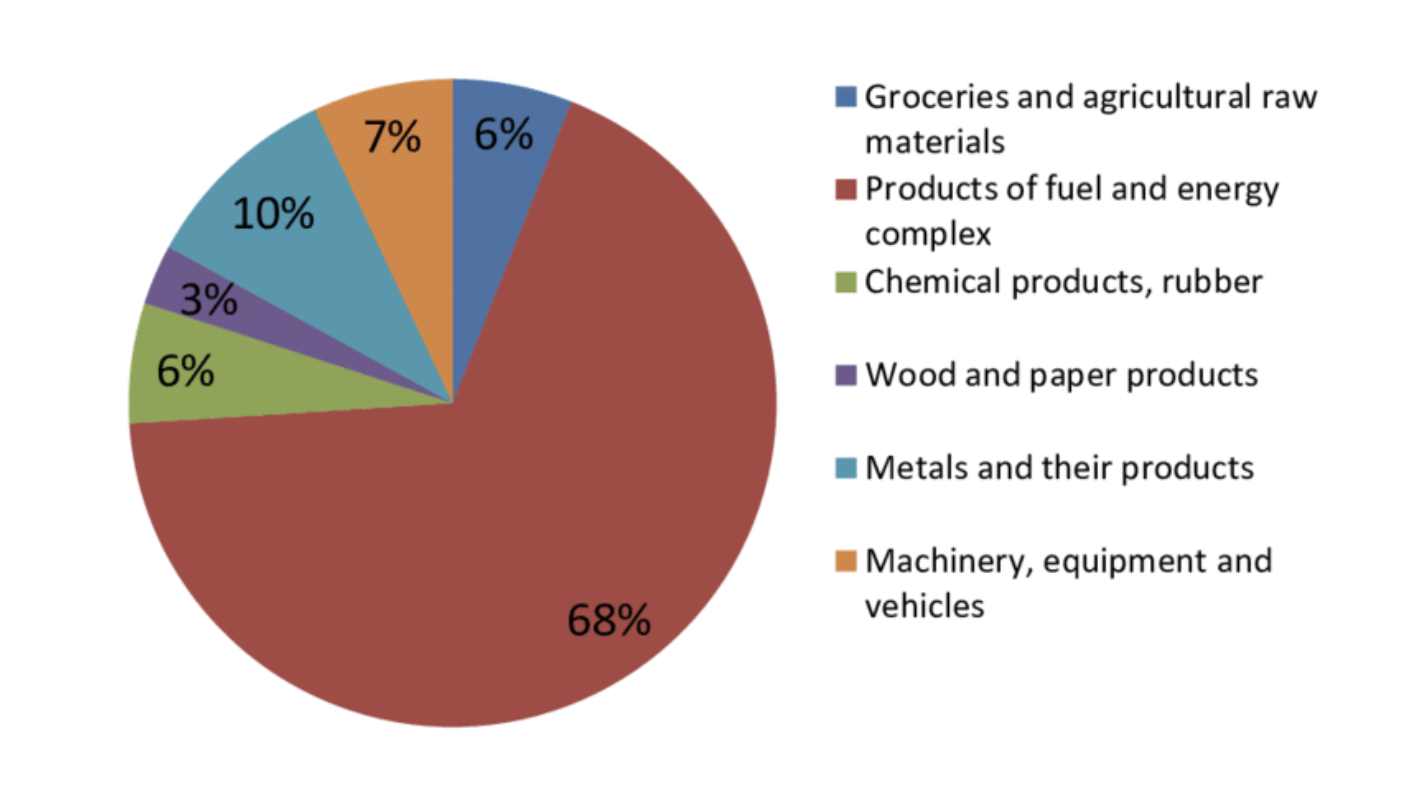

Contrary to conventional wisdom, I see potential in buying Russian Rubles against the Euro as a promising long-term play. Despite the skepticism surrounding the Ruble, Russia boasts vast commodity reserves, minimal foreign debts, and reduced dependency on imports. Historically, trust issues have plagued the Ruble, stemming from the Cold War era and persisting through strategic manipulation.

Contrary to conventional wisdom, I see potential in buying Russian Rubles against the Euro as a promising long-term play. Despite the skepticism surrounding the Ruble, Russia boasts vast commodity reserves, minimal foreign debts, and reduced dependency on imports. Historically, trust issues have plagued the Ruble, stemming from the Cold War era and persisting through strategic manipulation.

However, with global dynamics evolving and non-NATO countries increasingly willing to engage in trade using alternative currencies, particularly beyond the US dollar, Russia stands to benefit.

This shift in geopolitical alliances and trade patterns signifies a significant change, with Russia poised to emerge financially stronger than many Western nations. While this might be unsettling for the West, it’s essential to recognize the changing landscape without succumbing to propaganda.

In light of the Biden administration’s perceived weaknesses and the looming specter of a 40-trillion-dollar debt, global sentiments are shifting, questioning the traditional dominance of Western powers.

In light of the Biden administration’s perceived weaknesses and the looming specter of a 40-trillion-dollar debt, global sentiments are shifting, questioning the traditional dominance of Western powers.

While a unified BRICS currency remains a distant possibility, the currencies of these nations are undoubtedly asserting themselves. Among them, the Ruble appears particularly appealing.

In contrast to the West’s preoccupation with promoting concepts like Diversity, Equity, and Inclusion (DEI), and Environmental, Social, and Governance (ESG), some nations are adopting a more pragmatic approach to trade and diplomacy. They’re extending a straightforward offer: if you want to trade or are in need of aid, we’re open for business, with no hidden agendas.

In essence, while Western nations may be preoccupied with ideals, the rest of the world seems to be embracing pragmatic economic and diplomatic policies, which may ultimately prove more effective.

The post Is it time for a decline? first appeared on JP Fund Services.

The post Is it time for a decline? appeared first on JP Fund Services.

The post Is it time for a decline? first appeared on trademakers.