FOMO (Fear of Missing Out) isn’t exclusive to young crypto traders; historically, it applies to stock traders and those managing pension funds. More importantly, it serves as the driving force behind the growth of the financial industry.

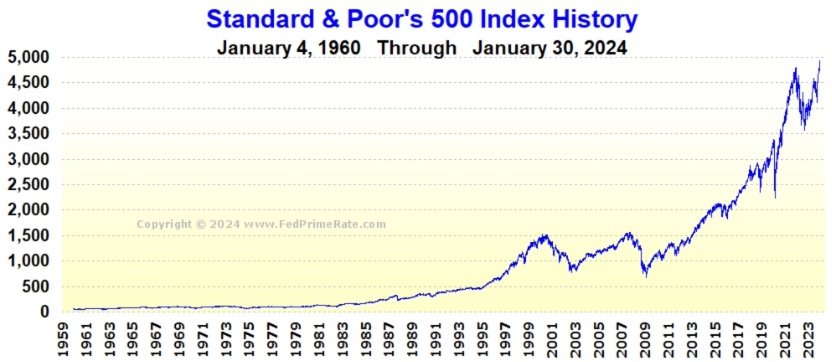

If we delve into the history of stock market growth, it’s been remarkably consistent. Looking back to the early 1930s, there have been hiccups along the way: WWII, the 1970s, the 2000 tech bubble, all roughly 30 years apart. In between these major setbacks, we’ve witnessed multiple corrections that allowed those with fresh capital to enter the market and ride the next wave. This cycle fosters the belief among many investors that it’s simply a matter of holding on, a principle my younger friends refer to as “HODL.”

As someone who lived through the 1970s and the tech bubble, I can’t deny the remarkable resilience of our stock markets against poor economic policies and risky maneuvers by financial institutions. However, I can’t forget that the consequences of poor decision-making by politicians and bankers were always borne by the general population: higher taxes, job losses, inflation, increased debts, and so on.

Moreover, just before these collapses, we witnessed a pattern: the euphoria of new highs led many bears to abandon their pessimism and embrace bullish sentiments, only to regret it shortly afterward. Recently, some pessimistic investors have begun to change their tune.

While the S&P 500 has shown impressive performance, primarily driven by the demand for a limited number of companies, I can’t shake the feeling that equity prices are becoming increasingly disconnected from the real economy. And history tells us what that usually means – people are going to get hurt

(When it comes to looking at long term index values, I wonder what the value would be today, if we stuck with the original companies, rather than kicking off those that failed and replacing them with stronger companies)

Optimistically speaking, one could argue that earnings weren’t disastrous, COVID caused damage but we’re rebounding, and there’s optimism about the US economy under Trump’s leadership. However, uncertainties remain, and economic indicators in an important election year may show exaggerated signs of recovery. We can also expect that bond yields remain volatile as traders try to outsmart the Fed, and vice versa.

Undoubtedly, there are numerous other arguments circulating, as is often the case before a collapse. But from my perspective, I see nothing but increasing risk for those buying equities at current levels.

Some argue that the US, often the focus of our attention, is faring better than the rest of the Western world. They anticipate that a Republican administration would further widen the gap between the USA and other nations, by prioritizing domestic policies over global growth.

Unfortunately, we can’t expect a similar shift in economic policy or focus in Europe, which is my primary concern.

European growth has relied on sustaining the German economy and redistributing some of its excess profits to less affluent neighbours. However, cracks are emerging in this policy. The burden of supporting an entire continent, compounded by factors like mass immigration, COVID, generous welfare systems, and regional conflicts, has become overwhelming. As Germany goes, so does Europe.

European growth has relied on sustaining the German economy and redistributing some of its excess profits to less affluent neighbours. However, cracks are emerging in this policy. The burden of supporting an entire continent, compounded by factors like mass immigration, COVID, generous welfare systems, and regional conflicts, has become overwhelming. As Germany goes, so does Europe.

The academic economic policies enforced by EU officials have inflicted as much damage on European businesses as the misguided emphasis on carbon reduction. Coupled with a multitude of growth-inhibiting regulations from the EU, it’s challenging to envision Europe breaking free from its downward spiral.

When European equity analysts advise buying quality, it’s akin to the strategy of investing in the “magnificent seven” in the USA. However, naming a European equivalent is difficult.

There’s a growing suspicion that governments and major institutions are colluding to keep stock markets afloat, fully aware that any faltering could lead to a catastrophic downturn of unprecedented proportions, with a potentially lengthy road to recovery.

This leaves us with a dilemma: Do we participate in propping up the market by going long or holding onto our investments, or do we remain on the side-lines or even go short, anticipating that the truth about our current economic situation will eventually surface, causing equity values to plummet?

None of us in the financial industry, or any industry for that matter, wish to witness an economic Armageddon, let alone contribute to its ignition. However, ours is an inherently self-serving business, and each of us must make decisions based on what we believe is right for ourselves.

Whatever you decide, please do not put all your eggs in one basket, because at some point you will be asked by your government to pay for their mistakes!

The post In a world of eternal optimism and ever-increasing stock markets, why is it always the Bulls whom the rest of the world has to bail out? first appeared on JP Fund Services.

The post In a world of eternal optimism and ever-increasing stock markets, why is it always the Bulls whom the rest of the world has to bail out? appeared first on JP Fund Services.

The post In a world of eternal optimism and ever-increasing stock markets, why is it always the Bulls whom the rest of the world has to bail out? first appeared on trademakers.