There’s nothing more annoying than wanting to do something but missing it by a few points or a few hours. Being English, disappointment seems to be the theme of the month.

A Labour government gets elected with a massive majority in Parliament, yet their share of the vote drops. The national team fails to show up at the Euro24 final—perhaps we should start taking afternoon naps; we might actually win something then. And while I’d love to spend more time on the beach drowning my sorrows, the skies have decided to open up and drown me instead.

On a more positive note, Trump’s new ear-piercing might boost his chances of getting re-elected, which seems to underscore the continued, unfathomable strength of the equity market. God only knows what would have happened if that twenty-year-old with the gun had slightly better aim. To say God wasn’t on Trump’s side might be ignoring the obvious.

I’ve discussed endlessly that we’re living through uncharted times, but how these various events will affect the markets is not so straightforward.

Take NATO ramping up its threats against Russia. This means more money and ammo wasted protecting Ukraine. If we also consider the baffling and, quite frankly, dangerous move towards using more electricity and fewer carbon fuels, one would think the price of metals like aluminium and copper would be firm. Yet, they are still falling.

Similarly, considering global warming, or at least the significant changes in weather patterns, grain prices should be stable. Especially with a growing global population and increasing demand from developing nations, but food prices are currently on the decline.

I believe that with the current dip, commodities are becoming increasingly attractive, and we could see some strong upward moves in the coming months. It’s just a matter of picking the right level to enter, which is hardly easy when so much of what’s happening in our markets is outside of straightforward supply and demand factors. At least that’s how it seems to me.

What I find most difficult is following the short-term money, which is currently moving in and out of products at a startling rate, pushing markets to levels I often feel are unjustified.

However, as the markets are always right, at least in the short term, I will spend the next few weeks looking for short-term opportunities to exploit. If I see any ideas worth pursuing, I’ll share them in additional commentaries.

As it stands, I still have the gold I bought a few years back, and it’s currently trading around 35% higher than where I bought it.

I am coming to terms with the fact that I have continually missed getting back into crypto, especially Bitcoin, because I have been too cautious, trying to pick the optimum level instead of just jumping in when it looked weak.

I think it’s time I just bought some and rode the waves, like everyone else seems happy to do. This doesn’t suit me, as this type of gung-ho trading takes me out of my comfort zone. But I’m not really happy watching this market go higher and not having any on my own books.

I am short on EUR/USD and have been for over a month. My reason is that Europe is far from healthy, with increasingly fractured politics, a poorly performing economy, and a war on its border. And there is little sign of a change in direction. On the other hand, if Trump returns to the White House, we can expect massive changes in the USA, and I consider any changes in direction across the pond to produce positive results.

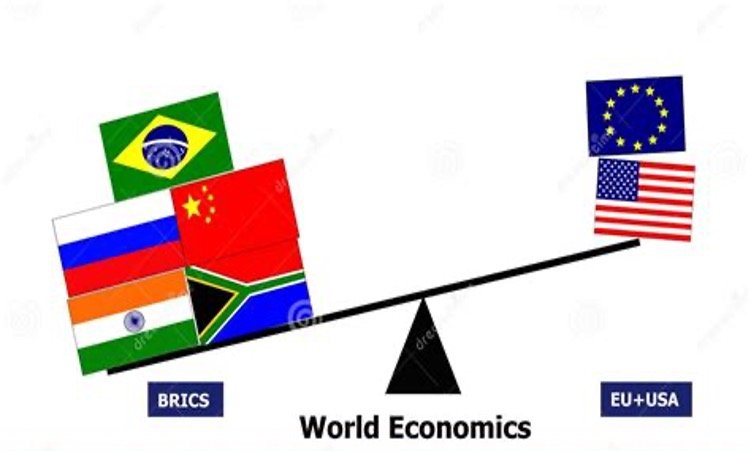

Obviously, there are many differing views on this, and the major concern for many is what will happen to the dollar when the BRICS really start to flex their muscles and attack the dollar’s status as a global reserve currency.

However, I see no reason why the Euro should strengthen if the BRICS decide to increase their control over international trading. But anything is possible in our ever-changing world, so time will tell.

The post I Should Have Bought Bitcoin Before Trump Did His van Gogh Impersonation first appeared on JP Fund Services.

The post I Should Have Bought Bitcoin Before Trump Did His van Gogh Impersonation appeared first on JP Fund Services.

The post I Should Have Bought Bitcoin Before Trump Did His van Gogh Impersonation first appeared on trademakers.