With Easter shortening the trading week, markets experienced a relatively subdued period, marked by mixed moves and ongoing consolidation.

However, under the surface, risks remain elevated as Trump-led trade headlines continue to loom large over sentiment. While there was no major escalation, the threat of retaliatory action and tariff surprises kept traders cautious.

The US Dollar attempted to stabilize after weeks of weakness, with the DXY index retreating 0.6% to close at 99.229, a critical support area that traders are closely watching. Dollar direction remains headline-dependent, with any news on trade negotiations likely to trigger swift reactions.

In Europe, the Euro moved sideways following a widely expected ECB rate cut and an in-line Eurozone CPI print of 2.2% YoY. Meanwhile, Sterling outperformed, shrugging off weak employment data to post a 1.6% weekly gain, ending just shy of the 1.33 mark.

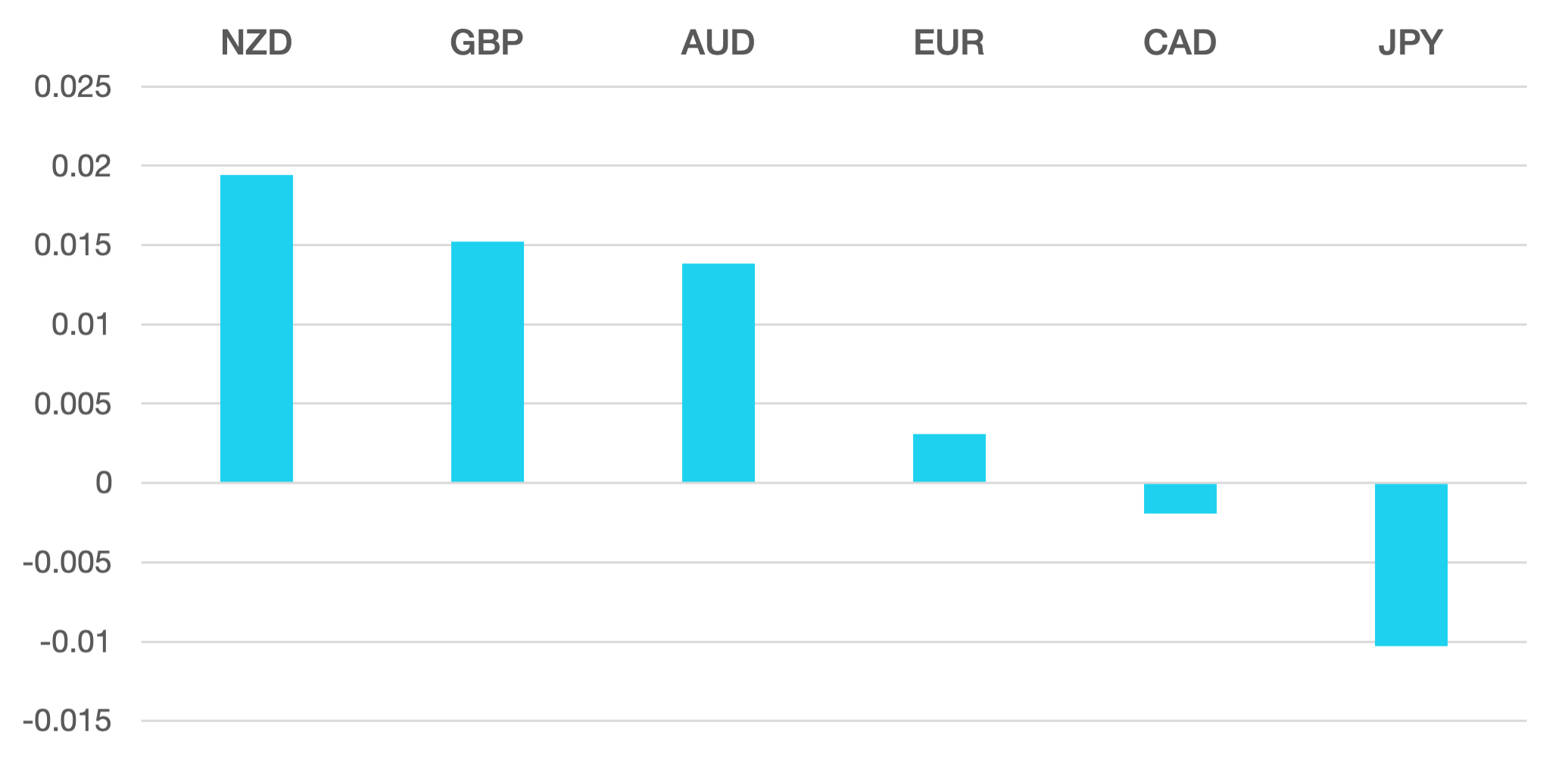

Commodity currencies extended their recovery, buoyed by falling global yields and a softer USD. The Canadian Dollar edged up 0.2%, while the AUD, NZD, and NOK each rallied around 1.5%. NZD led the weekly performance with a 1.94% gain, closely followed by GBP (1.52%) and AUD (1.38%).

Elsewhere, the Japanese Yen rallied 0.9%, benefiting from mild safe-haven flows. The Mexican Peso surged 3%, driven by strong risk appetite and demand for high-yielding EM assets.

Oil markets found renewed strength, with WTI rising 3.7% to close at $63.68, as buyers regained confidence after the prior week’s bounce. The price action has bulls feeling more comfortable, but any major shift in global growth expectations could quickly change the outlook.

Top 3 Technical Setups to Watch:

- EUR/USD: Bullish continuation in play. Holding above 1.1350; breakout above 1.1400 could extend to 1.1490.

- GBP/USD: Momentum strong above 1.33; next resistance at 1.3440.

- NZD/USD: Reversal building. Daily close above 0.6260 could drive move toward 0.6340+.

The Week Ahead:

Markets will once again focus on US-China tariff talks, with President Trump hinting that a deal may be nearing. Should progress materialise, we could see a strong risk-on rally across global assets. Until then, markets remain susceptible to sudden volatility from headline risk.

From a data perspective, this week brings a flurry of Manufacturing and Services PMIs globally, along with Japan CPI and US housing data. While economic indicators may provide direction, sentiment will continue to hinge on the geopolitical backdrop.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Easter Calm Masks Underlying Market Fragility first appeared on trademakers.