Markets welcomed a rare dose of optimism last week, as a solid US jobs report and tentative US-China trade thaw helped calm nerves.

While the macro backdrop remains challenging, the resilience of the US labour market and signs of renewed dialogue between Washington and Beijing offered a glimmer of hope. The Dollar ended softer but began showing signs of basing, and commodity currencies outperformed as risk appetite improved.

The US Dollar had a volatile but constructive week. After months of underperformance, a better-than-expected Non-Farm Payrolls report helped restore some faith in the US economy. The headline print of 139k jobs, combined with steady unemployment and stronger wage growth, shifted attention away from weaker ISM data earlier in the week.

DXY index slipped just 0.2% to 99.202, but the rebound late in the week hints at a possible base forming.

Fed rate cut expectations eased: odds of a July cut dropped to 17%, and even September is no longer seen as a lock.

US-China trade talks also helped support the greenback. A long-delayed call between Trump and Xi was followed by an agreement to resume formal negotiations, with delegations meeting this week in London. China’s temporary relaxation of rare earth export restrictions added to the constructive tone.

Still, structural challenges remain. Political infighting in Washington and ballooning deficits continue to cloud the Dollar’s longer-term outlook.

WTI jumped 6.7% to close at $64.73, marking its best week in months. While this lifts short-term sentiment, the $67 level remains critical to confirm a true bullish breakout. Without a fundamental shift—such as sustained trade normalization—gains may prove fragile.

With global trade still uncertain and yields creeping higher, further upside may require more than verbal progress.

The Week Ahead; the markets remain highly reactive to the Trump administration’s next trade moves. With Elon Musk now at odds with the White House and structural debt problems unresolved, investor confidence is likely to stay tentative.

Key upcoming data:

- UK earnings data

- Japan Q1 GDP

- Inflation prints from the US, Germany, Norway, and Mexico

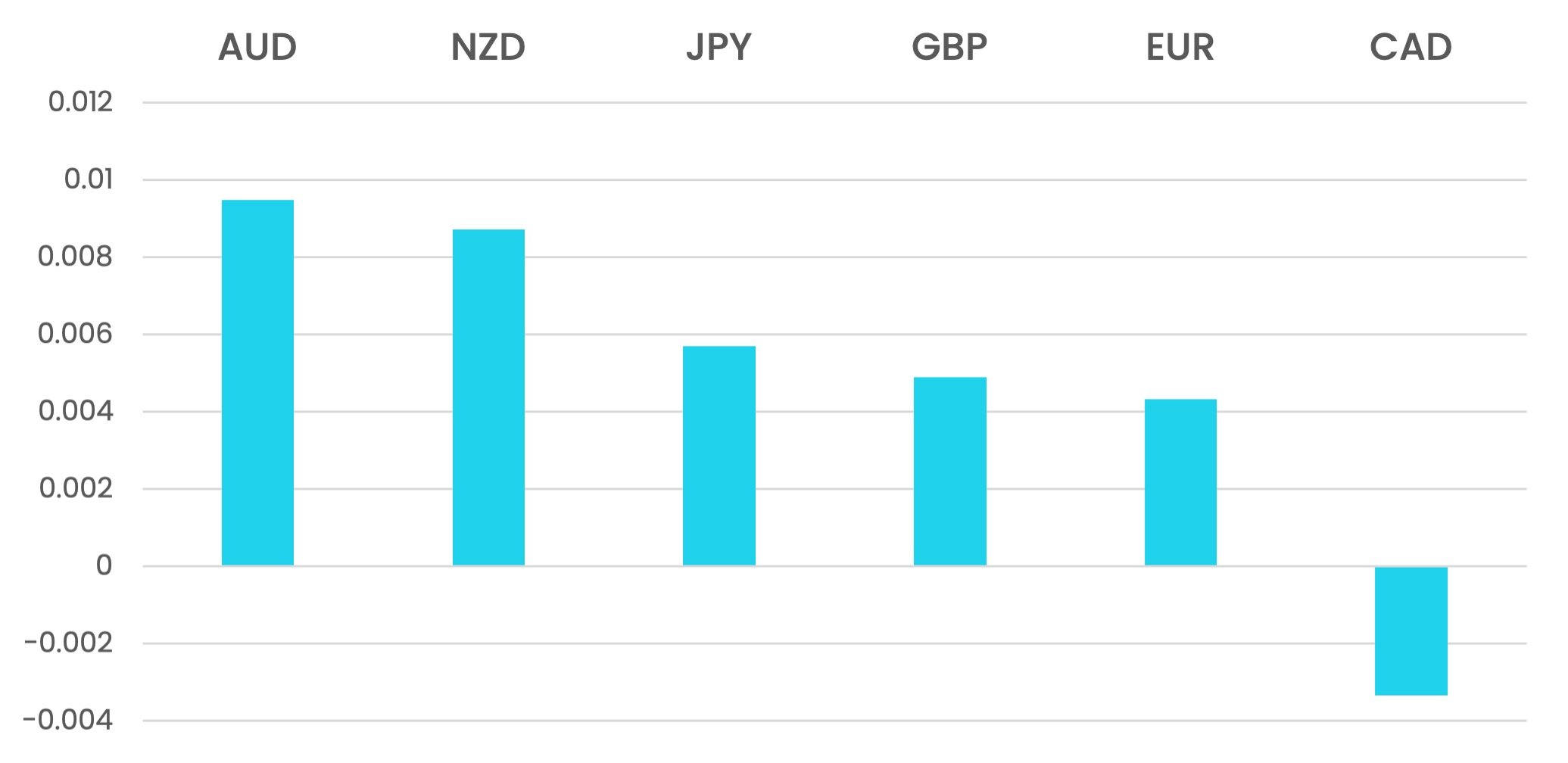

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Rebounds as NFP Trade Talks Reassure first appeared on trademakers.