Back in the day, this was the conundrum I often faced after a fruitful day of trading and a few post-work pints swimming in my belly.

Today, in the world of investments, it seems like we’ve been stuffing ourselves with Chinese delicacies for too long, and it’s about time we sampled what the Indians and Japanese have to offer.

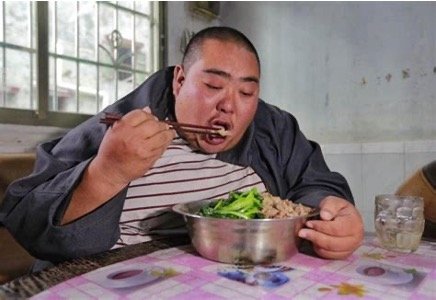

China? Well, it’s like that bloated friend at a buffet who’s had a bit too much to eat – weighed down by debt, disinflation, and demographics. Chef Xi’s got a pantry full of exotic ingredients, but his recipe for success remains a mystery to most of us. Maybe it’s best to hold off on seconds until he reveals his culinary masterpiece.

China? Well, it’s like that bloated friend at a buffet who’s had a bit too much to eat – weighed down by debt, disinflation, and demographics. Chef Xi’s got a pantry full of exotic ingredients, but his recipe for success remains a mystery to most of us. Maybe it’s best to hold off on seconds until he reveals his culinary masterpiece.

India, on the other hand, is looking like a spicy vindaloo – hot and appetizing. Foreign investments are picking up, and with a young, dynamic workforce, there’s plenty of room for seconds, or thirds.

Japan, with its recent interest rate hike, is like that dish you’ve forgotten about since the ’80s. Sure, it may seem a bit bland, but there’s potential for a flavorful comeback.

And if you’re feeling adventurous, why not try something from Singapore or Taiwan? Taiwan’s got some exciting AI dishes cooking up, but we’ll need to keep an eye on Chef Xi—he’s got a habit of sneaking into the kitchen when we’re not looking.

For those addicted to fast food and Coca-Cola, beware of what’s happening south of the border. Xi’s been sprinkling money down in Mexico, creating a smorgasbord of new industries. If we’re not careful, America might find itself facing more than just taco cravings—it could be a flood of foreign goodies that leaves it feeling queasy.

For those addicted to fast food and Coca-Cola, beware of what’s happening south of the border. Xi’s been sprinkling money down in Mexico, creating a smorgasbord of new industries. If we’re not careful, America might find itself facing more than just taco cravings—it could be a flood of foreign goodies that leaves it feeling queasy.

As for the market pundits getting all gung-ho about equities, well, it’s like they’ve had one too many cups of caffeinated coffee. But hey, who can blame them? When the market’s riding high and the naysayers are keeping quiet, it’s easy to get carried away.

Now, I’m no fan of chasing bull markets, especially when they’re frothing at the mouth with excitement. Sure, there’s still room for a bit more upside, but jumping in now feels a bit like trying to holding onto a runaway train – with your teeth.

So, while we wait for the market to serve up its next course, let’s not forget to protect our gains with some trailing stops. After all, in this game of economic roulette, it’s better to be safe than sorry.

And as for Bitcoin’s wild ride to the moon and back? Well, that’s a rollercoaster I’m happy to watch from the sidelines. As they say, it’s much more enjoyable being a spectator than a speculator in these turbulent times.

The post Chop Suey, Curry, or Sushi? first appeared on JP Fund Services.

The post Chop Suey, Curry, or Sushi? appeared first on JP Fund Services.

The post Chop Suey, Curry, or Sushi? first appeared on trademakers.