In financial markets, we primarily seek insights that can influence future price movements. We dissect political developments, parse central bankers’ statements, and quickly draw conclusions on how these factors might impact market behavior. For short-term trades, technical analysis often guides our decisions, but broader market perspectives tend to hinge on pronouncements from political and financial authorities.

However, in recent years, such statements have grown increasingly unreliable. In this year of pivotal elections, we’ve witnessed narratives shaped primarily to benefit incumbents seeking re-election. Once the dust settles post-election, we usually see corrections as more accurate information surfaces. In the UK, for example, post-election realities have revealed the limitations of pre-election promises, as evidenced by the public’s experience with their new Prime Minister and Chancellor. It’s become clear that campaign rhetoric is a poor foundation for economic forecasting.

Most of us are not privy to the true state of economic affairs, but one thing remains certain: our political class has an uncanny ability to exacerbate whatever challenges our economies face.

In recent months, I maintained a long position on the U.S. dollar, underpinned by an expectation of a Trump victory, which I viewed as broadly supportive for the currency. However, following the announcement that Biden would step aside and Kamala Harris would run for President, Trump’s odds took a significant hit, leading to a dollar sell-off that triggered my stop-loss at 1.1050.

While getting stopped out is never pleasant, I believe the stop was correctly placed, and I’ve accepted the outcome. Yet, the broader question remains: if the dollar continues to weaken, what implications might this have for global markets and the wider economy?

Rising prices for dollar-denominated commodities are a distinct possibility. I’ve maintained a long position in gold and as discussed, added a small basket of commodities, including metals (copper and aluminum) and agricultural goods (corn and wheat), which I plan to increase if prices see further dips in the short term.

I’ve stayed away from the energy sector for now, given its susceptibility to political intervention. That said, if crude drops below $60, the temptation to take a position will be hard to resist.

On a different note, I recently bought into Bitcoin on a dip—a move that was more fortunate than strategic, but I’m happy to hold it. The outlook for Bitcoin remains uncertain, yet it grows increasingly attractive as political instability rises. I’m unsure whether a Trump or Harris presidency would be more favorable for the cryptocurrency sector, but holding a modest position in BTC serves as a hedge, and I feel it diversifies my portfolio effectively.

I continue to steer clear of equity markets, preferring to sell into strong rallies in the S&P 500 rather than chasing momentum or the latest trend stocks.

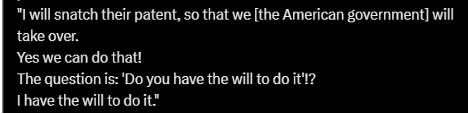

Much depends on the fate of the dollar, but it’s also critical to monitor shifts in the U.S. presidential race. Kamala Harris’s recent remarks about potentially confiscating pharmaceutical patents if drug prices aren’t reduced deserve close attention.

Even if made in a seemingly light-hearted manner, this kind of rhetoric poses a significant threat to private enterprise and offers a glimpse into the kinds of discussions happening within the political class.

As an Englishman, I watch with dismay as our own government appears increasingly disconnected from its working-class base, attacking free speech and disillusioned citizens, while rewarding union allies and controversial minority groups. This only reinforces how unpredictable and biased government actions can be and highlights the uncertainties we all face.

Nevertheless, we investors possess unique skills and the ability to leverage capital markets to bolster our financial security through speculation and hedging. In this sense, we are indeed fortunate—a select group with opportunities to capitalize on the volatility that others find unsettling.

The key, as always, is to seize those opportunities while they remain available.

If the dollar is on the ropes, and gold and BTC look positive, does this suggest a Harris win, and what should that mean for our stock markets?

These are the questions that are overhanging everything we do, and as we will not have an answer for another few months, there will be exciting times ahead.

The post Can Markets Serve as Predictive Tools Beyond Their Usual Scope? first appeared on JP Fund Services.

The post Can Markets Serve as Predictive Tools Beyond Their Usual Scope? appeared first on JP Fund Services.

The post Can Markets Serve as Predictive Tools Beyond Their Usual Scope? first appeared on trademakers.