The trend may not be positive, but it remains our friend. While the economic outlook continues to appear bearish, we need to align ourselves with it. This involves opting for selling into strong market upswings instead of trying to time market bottoms and navigate pitfalls.

Overall, we have been exercising caution, aiming to identify opportune entry points for assets that typically perform well during economic downturns, such as Gold. Occasionally, we have also considered adding Bitcoin (BTC) while taking short positions in assets vulnerable to economic turbulence, like equities and the Euro.

As traders return to their desks after an extended summer break, they are likely to seek ways to expand their portfolios and increase bonuses. Consequently, we anticipate heightened volatility in certain market sectors.

As traders return to their desks after an extended summer break, they are likely to seek ways to expand their portfolios and increase bonuses. Consequently, we anticipate heightened volatility in certain market sectors.

I’ve been closely monitoring the commodities sector and have some confidence that we will witness positive surprises in the coming months, particularly in food commodities and select metals.

A few weeks ago, I suggested that oil prices would see improvement, and, regrettably for drivers, this prediction has materialized. If you haven’t already entered a long position, I would advise against chasing higher oil prices. Instead, look for favorable entry points during profit-taking pullbacks.

Earlier this year, I experienced a loss by entering the natural gas market prematurely. Nevertheless, I maintain a favorable view of this market. Despite its current stagnation, I don’t foresee any significant bearish shocks on the horizon and therefore it may present a low risk buying opportunity.

I often discuss Gold, and my stance on precious metals, both Gold and Silver, remains positive. These assets serve as proven hedges against economic downturns. I also anticipate that some BRIC countries will increase their gold holdings as they prepare themselves for the inevitable challenge on the prominence of American Dollar.

I often discuss Gold, and my stance on precious metals, both Gold and Silver, remains positive. These assets serve as proven hedges against economic downturns. I also anticipate that some BRIC countries will increase their gold holdings as they prepare themselves for the inevitable challenge on the prominence of American Dollar.

I prefer physical Gold over futures as I want to keep it away from the grasping hands of government. However, if you are using derivatives, I lean towards recommending CFDs over Comex.

In the realm of food commodities, I’m becoming increasingly interested in Corn and Wheat due to their promising upside potential in the coming months. Conversely, the Cocoa market has shown excessive strength this year, prompting me to consider shorting Cocoa looking for a significant correction. I may also consider shorting Sugar if its rally continues a bit further.

The stockbroking community may express optimism, hoping for a robust year-end to bolster their bonus valuations. Nevertheless, my view on equity markets remains unaltered. A potential collapse in consumer spending due to rising house costs and energy bills is poised to impact profitability, and there may be larger surprises for companies heavily reliant on borrowed capital, who need to restructure their loans.

The stockbroking community may express optimism, hoping for a robust year-end to bolster their bonus valuations. Nevertheless, my view on equity markets remains unaltered. A potential collapse in consumer spending due to rising house costs and energy bills is poised to impact profitability, and there may be larger surprises for companies heavily reliant on borrowed capital, who need to restructure their loans.

My skepticism regarding central banks’ ability to control inflation remains firm. I see no viable path for them to achieve their 2% target without inflicting substantial harm on the overall economy. While we may engage in debates about minor percentage moves in either direction, we must fundamentally rethink fiscal policy. The patchwork solutions we have employed over the past two decades fall short of what is needed.

Governments may favor Keynesian economics, as it grants them greater control over the economy, but there is a question about the value of sticking to these theories, with our irresponsible spend today and pass the buck governments.

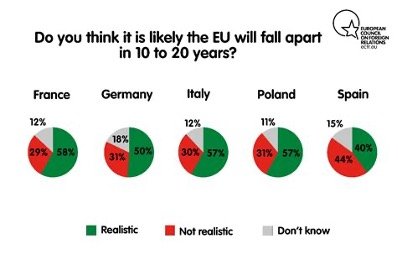

Lastly, despite the challenges faced by the USA, I maintain a preference for the increasingly challenged dollar over the Euro, at least in the medium term. Europe grapples with a dearth of investment, limited natural resources, a questionable work ethic, a dominant government with minimal opposition, reliance on energy imports from unfriendly nations, and the ongoing conflict on the EU’s border—a situation that remains unresolved.

Lastly, despite the challenges faced by the USA, I maintain a preference for the increasingly challenged dollar over the Euro, at least in the medium term. Europe grapples with a dearth of investment, limited natural resources, a questionable work ethic, a dominant government with minimal opposition, reliance on energy imports from unfriendly nations, and the ongoing conflict on the EU’s border—a situation that remains unresolved.

That concludes my update for this week. Three months post-operation, the doctor has removed the plasters, allowing me to spend more time at the computer. So, stay tuned for further timely commentary.

The post Back in the Driving Seat first appeared on JP Fund Services.

The post Back in the Driving Seat appeared first on JP Fund Services.

The post Back in the Driving Seat first appeared on trademakers.