This past week has been marked by a series of events that disrupted market expectations and posed significant challenges.

From Donald Trump’s prominent appearance at Notre Dame to the swift removal of Syria’s controversial leader, and Bitcoin’s struggle to sustain momentum after last week’s robust performance, the developments have been both diverse and impactful.

For over-leveraged investors heavily weighted in altcoins, recent market movements may have derailed carefully laid plans. While this volatility can feel like a setback, it also provides a valuable lesson. Investing is inherently an educational journey, and the price of that education is often paid in market losses.

As a Bitcoin holder, I share the disappointment over the lack of follow-through earlier this week. However, it is critical to approach cryptocurrencies as tradable assets, especially as these markets attract increasing participation from institutional and professional traders. Emotional decisions unsupported by solid research or analysis often lead to regrettable losses.

The long-term outlook for Bitcoin remains promising, with sustained demand and growing interest. However, expecting continuous upward momentum without occasional corrections is unrealistic. Events like this week’s sell-off highlight the risks of fear of missing out (FOMO) and over-leverage. For many in the crypto investing community—some 500,000 of whom reportedly liquidated their positions—this experience could lead to improved strategies and healthier long-term participation. After all, those crying into their champagne glasses may one day reflect on this as a valuable lesson learned, especially now that strength appears to have returned to the crypto arena.

The ousting of Syrian President Bashar al-Assad has surprised many observers, particularly given the rapid pace of the development. While the geopolitical implications are still unfolding, the immediate impact on markets has been clear. Gold, which was expected to ease back, appears poised to retain its strength in the coming days or even weeks. As the saying goes, “Better the devil you know than the devil you don’t.” My modest gold holdings remain untouched, reflecting a long-standing strategy to maintain stability amid global unpredictability.

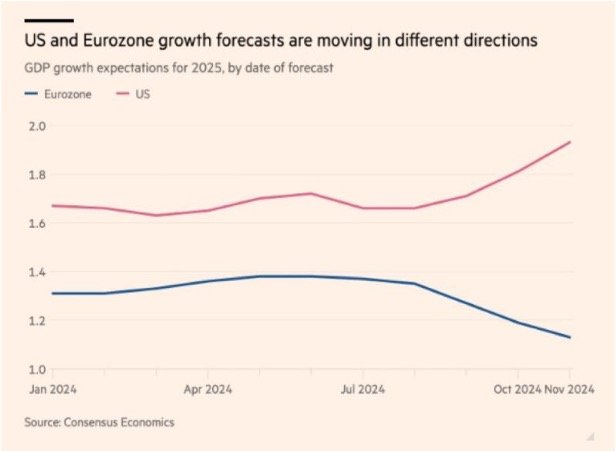

For European investors, the ongoing divergence between the euro and the U.S. dollar is an increasing concern. The stark contrast in economic trajectories across the Atlantic highlights underlying structural weaknesses in European economies. While U.S. markets are buoyed by renewed confidence following Trump’s victory, Europe faces sluggish growth and a lack of meaningful reform. These dynamics are unlikely to strengthen the euro – or sterling – against the dollar in the near term. This disparity should prompt reflection among pro-EU Europeans, who seem reluctant to confront the challenging economic outlook facing the region.

Regarding currencies, the development of a BRICS currency appears to have stalled, and for the time being, it poses no significant threat to the dollar’s global dominance. U.S. policy under Trump, including the threat of a 100% tariff on BRICS imports, seems to have effectively neutralized the initiative.

Meanwhile, China appears to be contemplating allowing the stable yuan to slip against the dollar. However, this move could backfire if it encourages the outflow of large amounts of wealth overseas. This development will need to be closely monitored.

This week’s main story has been the CPI figure, with everyone talking about cuts in US interest rates. It appears that over 90% of analysts expect a 0.25% cut by the FED, so that is probably going to happen. In truth, we can look back at this crazy year and say those in authority have managed the fiscal situation in the USA extremely well. Let’s just “hope” they continue to do the right thing!

As we enter the festive season, with only one more week before Christmas interruptions, it seems most market players have already reduced their exposure to lock in bumper bonuses. However, this doesn’t mean we won’t see some unusual and unexpected market activity before the year ends.

The coming weeks will present excellent opportunities to exploit, but caution is advised. Keep your trading emotions in check, and don’t let them ruin a great Christmas.

The post A Series of Disruptive Events first appeared on JP Fund Services.

The post A Series of Disruptive Events appeared first on JP Fund Services.

The post A Series of Disruptive Events first appeared on trademakers.