On August 2nd, 1974, a young 17-year-old, a very rough, working-class kid, took a bus to Fenchurch Street in the City of London, entered the offices of Merrill Lynch, Pierce, Fenner, and Smith, and embarked on a journey that has yet to finish.

I had much more hair and all my teeth back then, but my knowledge of what I was doing or the world I had entered was zero. As I walked through the office to my desk, I don’t know what was more uncomfortable, me or the new ill-fitting suit I was wearing.

I had much more hair and all my teeth back then, but my knowledge of what I was doing or the world I had entered was zero. As I walked through the office to my desk, I don’t know what was more uncomfortable, me or the new ill-fitting suit I was wearing.

My only school qualification was an “O” level in Statistics, and amazingly this had been sufficient for me to secure a job as an assistant Technical Analyst at the world’s largest investment company.

Here I was, a kid from an inner-city housing estate, whose Father worked in the Docks—physically carrying bags of cement and sugar from the holds of ships and putting them on trucks—and a mother who worked in a sweatshop making clothes. Now I was working with some of the most professional investment brokers that had ever existed.

To say I was a very lucky boy is the understatement of all understatements, but on that day, God was on my side, and I’ve never looked back.

More importantly, I loved every minute of working in this industry, even though I must admit that coming to terms with using new technologies has often been a pain in the backside.

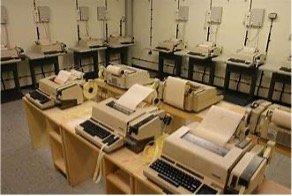

When I started, even in the offices of the great Merrill Lynch, we had no computers. Just Reuters screens that would display the last traded price of a select number of instruments. There were, of course, no charts outside of those I updated each day by hand. Shortly after I joined, Reuters installed a dot matrix printer, which would provide us with a limited amount of news stories. We were so impressed that someone was employed to read the stories and shout them out so all the brokers could stay updated with the latest information.

As a major broker, we had direct phone links to most of the commodity exchanges in London. However, when passing orders to the USA, instructions were sent via Telex, from a room full of machines and ticker-tape. If you were lucky, an order sent to New York might be filled within 3 hours. But if you wanted to trade in Chicago, all orders went via New York. Therefore, more often than not, you would not get a fill until the following day, and incredibly, few clients complained.

As a major broker, we had direct phone links to most of the commodity exchanges in London. However, when passing orders to the USA, instructions were sent via Telex, from a room full of machines and ticker-tape. If you were lucky, an order sent to New York might be filled within 3 hours. But if you wanted to trade in Chicago, all orders went via New York. Therefore, more often than not, you would not get a fill until the following day, and incredibly, few clients complained.

Obviously, young folks today hear about the 1970s and the terrible state of the economy, especially in the UK. But for a young boy not yet 20 years old, these were fabulous times.

We were still suffering from the Oil crisis, but the immense wealth generated in the Middle East flooded into our office as Arab princes enjoyed speculating on sugar and other commodities. At that time, Bunker Hunt was still using Saudi money to increase his silver position. Luckily again, Oil futures markets didn’t exist. I can only guess at the price oil would have reached if these crazy Middle Eastern speculators had started to trade Oil futures.

Today’s major market, Forex, was still in its infancy. Indeed, Merrill did not establish a forex brokerage department until the end of the 70s, which consisted of two brokers, a trader, and two girls in the back office handling settlements by hand.

Since that time, our industry has experienced significant changes, including the emergence of new markets, advancements in technology, and a substantial increase in the number of traders and speculators. The growth of financial markets during the 1980s was noteworthy, but the most profound impact has come from the rise of online trading platforms and the ability to access markets directly through smartphones.

Since that time, our industry has experienced significant changes, including the emergence of new markets, advancements in technology, and a substantial increase in the number of traders and speculators. The growth of financial markets during the 1980s was noteworthy, but the most profound impact has come from the rise of online trading platforms and the ability to access markets directly through smartphones.

Reflecting on my early days, it’s clear that a lot has transformed, creating a stark contrast. However, certain aspects have remained constant.

Most speculators still lose money. This is because no matter how much we know and how much information we carry on our phones, most speculators still focus on the profit opportunity and do too little to minimize losses. The markets may have changed, but our emotions haven’t.

We still experience boom and bust periods, with frenzied buying and panic selling, and we still consider every trade we enter as the one that is going to pay off the mortgage. Amazingly, I am still reading recommendations on social media, including the immortal words, “The trend is your friend,” which is something I was told when learning about the markets in the 70s. And those words are still costing investors a lot of money!

I can go back almost 50 years and discuss what a joy it’s been to work in this industry all my life. I can only hope that someone entering the business today can make a similar observation in 50 years’ time.

With so much happening in the financial world, I don’t know if the markets will last another 50 years. As governments encroach on our financial freedoms, the future of speculating becomes more questionable, so enjoy it while you can.

Moreover, if you’re spending lots of money trying to create a perfect trading system, you should be careful about what you wish for.

Moreover, if you’re spending lots of money trying to create a perfect trading system, you should be careful about what you wish for.

Many people have worked for a long time on making such systems, but most of the time, they haven’t succeeded. If you do come up with a system like that, it’s better to keep it a secret and not sell it. If I find out someone has a system like that, I won’t want to trade against it. And in the end, if people stop trading, the markets will disappear.

These markets don’t come with any guarantees, and that’s what makes them the most interesting and enjoyable field to work in.

The post A Month for Reminiscing first appeared on JP Fund Services.

The post A Month for Reminiscing appeared first on JP Fund Services.

The post A Month for Reminiscing first appeared on trademakers.