In recent years, I’ve emphasized that significant geopolitical shifts are increasingly shaping capital markets. While some might question why we’re mixing politics with finance (like mixing cheap tequila with poorly thought through speculative decisions – both can lead to regrettable morning-after consequences), it’s crystal clear that political developments now drive markets more than traditional indicators like employment rates, inflation data, or what central bankers mumble after their third coffee.

Three months into President Trump’s administration, his non-traditional, nationalist approach is reshaping global economics faster than you can say “HODL”. Central to this transformation is his aggressive stance on trade – especially his love affair with tariffs. He wields them like a reality TV host with a “You’re Tariffed!” catchphrase. While international resistance remains strong, Western investors should understand the method behind what some might call madness.

The Trade War with China: When Giants Have a Slap Fight

Trump’s trade war with China didn’t just appear like a mysterious hair piece on a windy day.

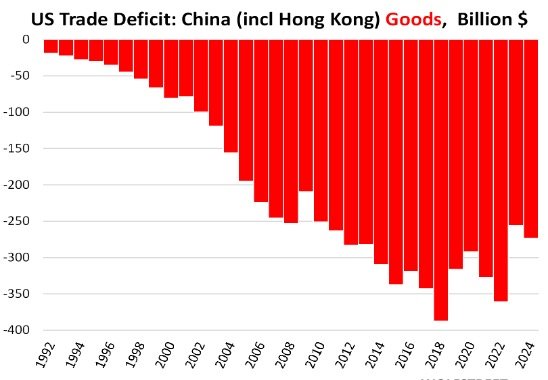

For decades, China’s rapid industrial ascent – fuelled by state subsidies, intellectual property “borrowing” (wink wink), and a currency valued lower than Kier Starmer’s approval rating! – has challenged Western industries. The official U.S. trade deficit with China reached over $419 billion in 2018, dropping to under $300 billion in 2024.

However, Trump prefers quoting the global deficit of around a trillion dollars – a number so large even Elon Musk would check his wallet twice.

Tariffs, while controversial, aim to recalibrate this imbalance. They’re like Bra for the economy bought on Temu – uncomfortable but designed to reshape things. The goal? Restore American manufacturing competitiveness and protect strategic industries from state-backed foreign competition. Critics argue tariffs are just taxes on consumers that disrupt global supply chains, while supporters say economic sovereignty is needed – because nothing, allegedly, says “America First” like paying more for everything!

However, this confrontation has created uncertainty so thick you could spread it on toast. Many investors are making decisions based more on headlines than fundamentals, which is like navigating by following whatever shiny object catches your eye. In such an environment, a conservative investment strategy might be smarter until the economic equivalent of GPS reception improves.

Unpredictable Policy Moves: The Presidential Plot Twists

Even experienced analysts struggle to anticipate Trump’s tactics. On April 9, he announced a 90-day window for countries to renegotiate tariff terms – a surprise move that caught markets with their proverbial pants down. It reminded us all that we’re navigating a world where policy reversals are more common than claims that the planet will be saved by increasing taxation on the poor.

While uncertainty is the new normal (like wearing paper masks during covid), it won’t last forever. Investors should focus less on daily fluctuations and more on preparing for long-term opportunities when clarity returns. History shows market dislocations often precede recoveries, provided you have the patience to sit around and wait for the paint to dry.

Trump’s Strategic Priorities: America’s Economic Glow-Up

Trump’s core economic philosophy centres on the belief that the U.S. has carried global development costs like a friend who always gets stuck with the dinner bill. His strategy involves leveraging America’s massive consumer market to renegotiate relationships in a way that better serves U.S. interests – essentially saying, “I bought the appetizers, entrées, AND desserts, so maybe you could tip the waiter?”

This presidency differs significantly from his previous term – it’s like the sequel that decided the original wasn’t dramatic enough. Trump’s focus on making enduring structural changes is creating a temporal disconnect, leaving investors navigating a landscape misaligned with their usual timeframes.

His public feuds with Federal Reserve Chairman Jerome Powell exemplify this approach. Trump views monetary policy through his economic agenda lens – any deviation faces criticism faster than a celebrity tweet faces backlash. This combative style may feel jarring, but it aligns with his goal of pressuring institutions into following his executive priorities.

The Road Ahead: Risk, Opportunity, and Aspirin

Trump’s fiscal manoeuvrers have disrupted markets much like a rogue trader unveiling a hidden position. However, dismissing potential long-term U.S. benefits would be premature. Reasserting trade control, rebalancing deficits, and reducing foreign manufacturing dependence could enhance American resilience – though these benefits will not be seen for some time.

The question remains: Will Trump succeed or will international resistance and domestic politics derail his vision. The answer remains unclear, and investors should prepare for ambiguity that lasts longer than a line of coke on Hunter Biden’s coffee table.

In these times, trying to perfectly time the market is like trying to catch a greased pig while blindfolded. Instead, focus on strategic positioning – maintaining flexibility, preserving capital, and being ready when the fog clears.

Short term, managed risk is fine, but this isn’t the time to bet the farm on tomorrow’s forecast – unless your crystal ball works better than most weather apps!

The post We Know the Goal, but Tomorrow’s Chaos? Anyone’s Guess! first appeared on JP Fund Services.

The post We Know the Goal, but Tomorrow’s Chaos? Anyone’s Guess! appeared first on JP Fund Services.

The post We Know the Goal, but Tomorrow’s Chaos? Anyone’s Guess! first appeared on trademakers.