Last week was nothing short of chaotic as global markets absorbed a relentless barrage of tariff news, reversals, and retaliations.

The White House’s shifting stance on trade policy left investors bewildered, with even administration insiders seemingly struggling to keep up. The result? Sharp moves across FX, bonds, and equities – and a clear message that confidence in US economic leadership is waning.

The Dollar was the week’s biggest loser, despite rising yields and occasional risk-off stretches. The DXY index dropped 3% to close at 99.783, testing key support before bouncing slightly into the weekend. Weaker-than-expected US CPI data added to the downward pressure, reinforcing doubts about both inflation momentum and policy coherence.

In stark contrast, the Swiss Franc surged 5.3%, cementing its role as the premier safe-haven currency amid geopolitical turmoil. The Japanese Yen also rallied strongly, up 2.4% against the Dollar, while the Euro gained 3.6% to close at 1.1358, buoyed largely by capital outflows from the US.

The British Pound managed gains against the Dollar, but lagged most other major currencies, caught between USD weakness and lackluster UK data.

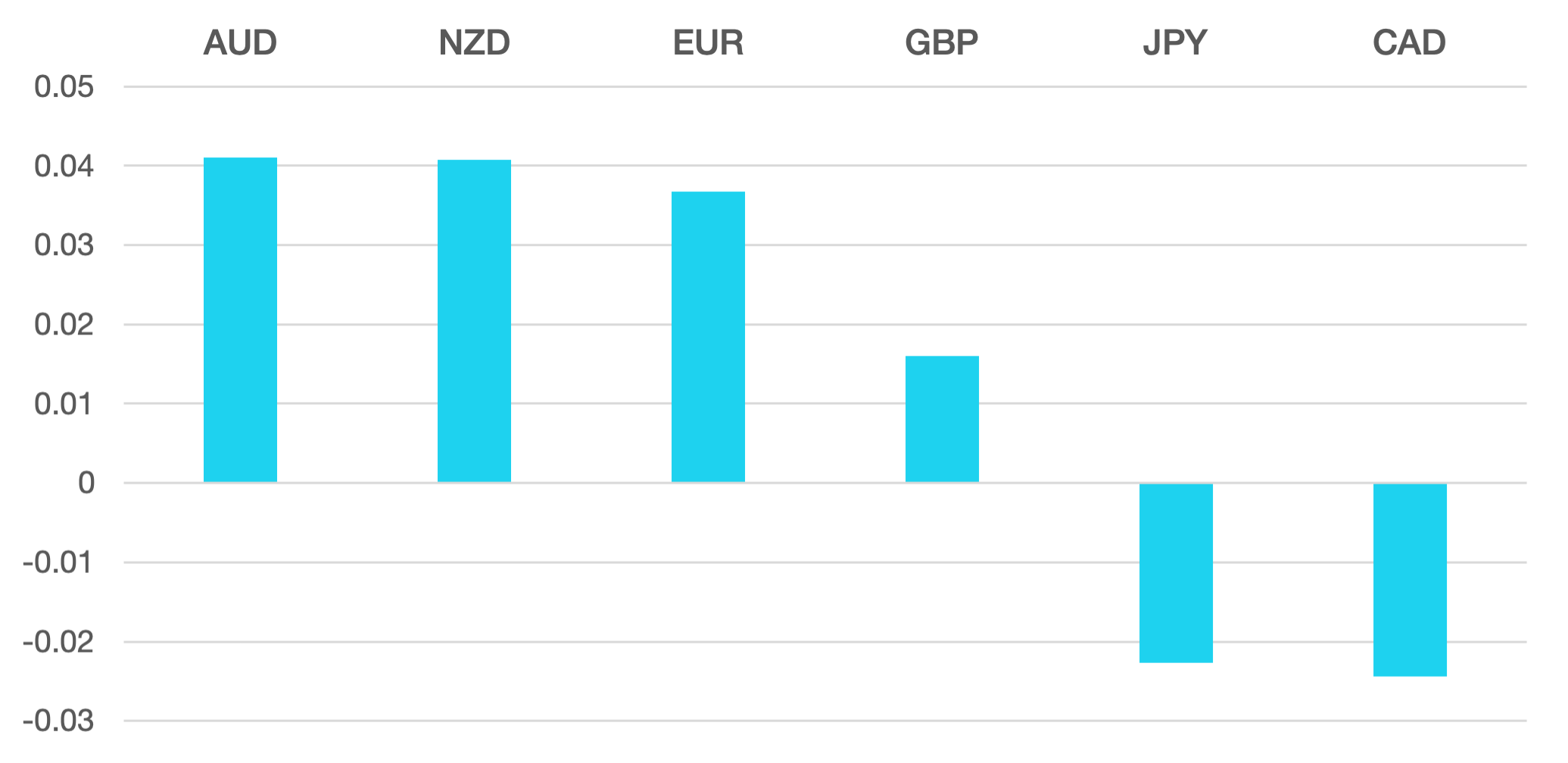

Commodity currencies posted a sharp recovery as risk sentiment flipped mid-week. The Australian and New Zealand Dollars each gained over 4%, while the Canadian Dollar jumped 2.5%. The Norwegian Krone rose 1%, and the Mexican Peso edged up 0.5%.

Markets were initially rattled by the start of reciprocal US tariffs, but relief came after a surprise 90-day postponement for certain goods, including high-tech imports like smartphones and chip-making equipment. This move was interpreted as a tactical retreat in the face of sharp Treasury market selloffs, which saw yields spike and sparked speculation about declining foreign demand for US debt. The correlation between bonds and equities broke down, with both suffering simultaneously before stocks found their footing.

Amid all this, Gold hit fresh record highs, as investor appetite for traditional safe havens intensified. Meanwhile, WTI crude oil remained under pressure, falling 1.3% for the week despite bouncing off an intra-week low of $55, and closing at $61.43.

The Week Ahead

Markets now face a test of whether recent relief is sustainable or just a pause in a deeper risk repricing. News that the US will exclude key product categories from tariffs could encourage a risk-on tone to start the week – but as always, traders remain on edge for another sudden headline-driven reversal.

On the data front, expect a busy calendar with inflation readings from the UK, Eurozone, Japan, Canada, and New Zealand, alongside interest rate decisions from both the ECB and Bank of Canada.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Tariff Whiplash Leaves Dollar Reeling first appeared on trademakers.