Last week was a turning point. After months of buildup, President Trump’s sweeping reciprocal tariffs finally landed, and the scale and scope caught markets off guard.

The impact was immediate and severe: equities plunged, Treasury yields fell, and volatility surged. China’s swift retaliation added fuel to the fire, escalating rhetoric and raising fears that a full-scale global trade war is now underway.

The tone has shifted from cautious optimism to outright concern. The DXY index dropped 1.1% to 102.892, reflecting both the market’s view that the US may suffer economically and a renewed appetite for diversification away from the Dollar. Still, the Greenback clawed back some losses into Friday, supported by short-covering and haven demand against more vulnerable currencies.

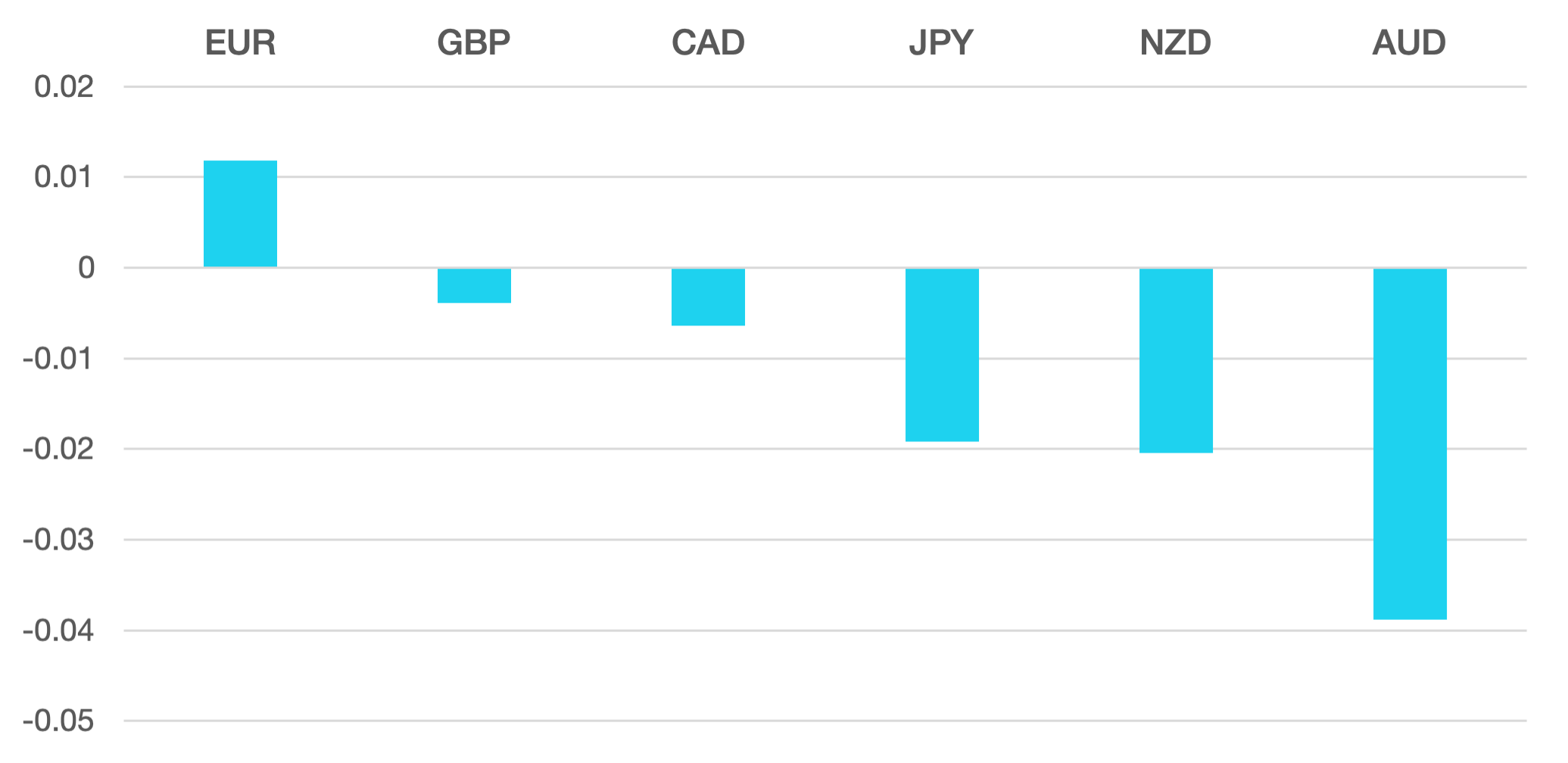

The Euro had a strong week, rallying 1.3% to close just below 1.10. With flows shifting away from the Dollar, the Euro is increasingly being seen as a secondary safe-haven play. Eurozone data was modestly positive for once, and the single currency took full advantage.

Sterling lagged, losing ground against both the Dollar and the Euro. GBP/USD closed marginally lower at 1.29, while EUR/GBP jumped 1.5% to just under 0.85.

Commodity currencies bore the brunt of the risk-off environment. The Australian Dollar collapsed nearly 4%, hammered by fears over its trade dependency on China. The NZD fell 2%, CAD dropped 0.7%, and NOK tumbled 2.6%. The Mexican Peso held surprisingly steady, while JPY and CHF soared 2% against the Dollar as classic flight-to-safety trades.

Oil prices confirmed the bearish shift, with WTI plunging nearly 10% to close at $62.27 after breaking key support at $65. Fears of a global demand shock due to tariffs finally overwhelmed the short-lived bounces seen in prior weeks.

Looking ahead, the focus remains squarely on tariffs. The market will react to both direct policy changes and diplomatic headlines, with any surprise retaliation or attempted de-escalation capable of triggering sharp price moves.

Data-wise, we’ll see CPI figures from the US, Germany, Norway, and Mexico, and a likely rate cut from the RBNZ, but macro data is playing second fiddle right now. As long as tariff tensions dominate, expect market sentiment to remain fragile, and price action to stay reactive.

Volatility is here to stay, and any rallies — in risk assets or risk-sensitive currencies — should be viewed cautiously. Until we get clarity on how the global trade landscape will evolve, the base case remains one of continued risk aversion.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Trade War Shockwaves Rock Global Markets first appeared on trademakers.