According to the latest data, since Donald Trump took office, the United States has seen over $3 trillion in promised investment, creating taxpaying jobs for many Americans.

In addition, Elon Musk at DOGE has uncovered nearly a trillion dollars in waste and corruption, which is set to be addressed soon. From an economic standpoint, this makes a lot of sense to me.

In contrast, Europe is struggling. It faces a war on its doorstep, internal divisions between nations, and conflicts between the global ambitions of its politicians and the needs of the people who elect them.

While the U.S. is grappling with the costs of its foreign influence and defence spending, European politicians continue to spend money they don’t have on projects that the public neither wants nor can afford – such as the €800 billion proposal to create an EU army.

At the same time, while Europe pours billions into addressing global carbon issues – mainly driven by the economic growth of China and India – the U.S. President has declared that the U.S. will “Drill, Baby, Drill” in order to reduce energy costs for both factories and the general public.

I’m not here to debate the moral implications of these policies, but from a purely economic perspective – especially in the short term – the fiscal outlook for the United States seems far more promising than that of Europe.

Given this, one might ask: why are the Euro and the British Pound still holding strong against the U.S. Dollar?

There are certainly many well-reasoned arguments that could be put forward, but I suspect most of them would be based on statistical analysis or ideological beliefs rather than on fiscal reality.

As a Brit living within the EU, I am keenly aware of the narrative being spread across the continent, where we are constantly told that what is happening in America is bound to fail. However, the narrative being pushed by Europe’s elite is at odds with what’s happening on the ground – declining living standards and rising social issues. The disconnect between EU and UK leadership and their people, alongside the use of smoke and mirrors in Europe, is striking.

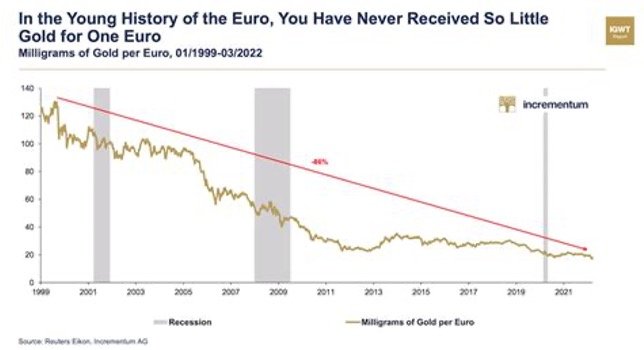

Additionally, having traded gold during its decline in the late 1990s – when many European central banks essentially gave away their gold – I’ve witnessed the purchasing power of the Euro fall by over 90% compared to gold.

No matter how I analyse the situation, it’s clear that the U.S. is attracting investment capital that Europe isn’t. The U.S. is also reducing government spending and cutting waste, while Europe continues to increase spending without addressing the trillions lost to waste, mismanagement, and corruption, yielding little to no return.

Given all this, if I had to choose between investing in “USA Inc.” or “Europe Inc.,” the decision would not be challenging. Of course, everyone has their own reasons for investing, but when we compare the financial management and outlook of these two global powerhouses, but there is little debate about which one seems the safer bet.

We will undoubtedly see speculators buying and selling currencies based on technical analysis – an analysis that can, in the short term, often turn into self-fulfilling prophecies. However, at the end of the day, it’s the fundamentals that will determine real value. And when comparing the Euro and the Pound to the Dollar, the fundamentals simply aren’t favourable for the former. As a result, these currencies are likely to weaken – perhaps significantly.

I’d love to hear your thoughts, particularly if you see things differently. I’ve gone short on both the Euro (1.08) and the Pound (1.30), and I’d be open to adding more if these currencies rally further.

Regarding the Commodity Space: Gold and Oil

When it comes to commodities, particularly gold and oil, there are a few difficult decisions to make.

Since my first report on gold about three and a half years ago, I’ve been consistently bullish on the metal. There are two main reasons for this: the growing concern over the economic trajectory and the ever-expanding debts being accumulated by Western nations, and the potential consequences of Western governments introducing Central Bank Digital Currencies (CBDCs).

I still strongly believe in holding gold, especially physical gold, but the rally we’ve seen since the beginning of the year feels a bit excessive – almost too much, too quickly. I’m not willing to go short or sell my physical holdings, but last week I sold some out-of-the-money 3350 calls, expiring in May, for $12. It’s a speculative trade, but given where I bought in ($1800) and what my physical gold would be worth if the market rallies another 10%, I’m hoping to capture a few extra pennies on my gold exposure, in case the current rally stalls.

As for oil, prices have dropped significantly since Trump took office and signed executive orders to boost exploration and production in the U.S. However, we’ve seen solid support around the $65-67 level.

Currently, oil is holding around the $69 mark, but it’s difficult to determine whether this is just a temporary correction or if we’ll range between the mid-$60s and mid-$70s for the rest of the year.

Of course, the recent attacks on Tesla by political leftists – ironically, the same people who urged us to buy electric vehicles just a couple of years ago – along with the right’s move away from green energy, could lead to higher demand for fossil fuels. This could have a positive effect on oil prices, or at least help to support them.

The first quarter of this year has been pretty good, and looking back, we’ve had a success rate of over 80%, trading across a broad array of products. This doesn’t mean this success will continue, but if we do slip up, at least we’re playing with money we took out of the market.

Anyway, onwards and upwards! I’m writing this before Rachel Reeves, the UK’s under-qualified Chancellor of the Exchequer, makes her Spring Statement. Let’s see what the future holds for her, and us, in the coming quarter.

The post A Brief Moment of Reflection and Explanation first appeared on JP Fund Services.

The post A Brief Moment of Reflection and Explanation appeared first on JP Fund Services.

The post A Brief Moment of Reflection and Explanation first appeared on trademakers.